List of Service Charges by SBI Bank - Summary

Service Charges by SBI Bank: A Comprehensive Overview

The State Bank of India (SBI) has recently made important changes regarding service charges that all customers should know about. These service charges by SBI Bank will come into effect from July 1, 2021. They cover various aspects, such as the number of free transactions allowed each month, ATM withdrawals, transfers, and other non-financial transactions.

Detailed Breakdown of Service Charges by SBI Bank

Here is a list of five important service charges by SBI Bank that you must be aware of:

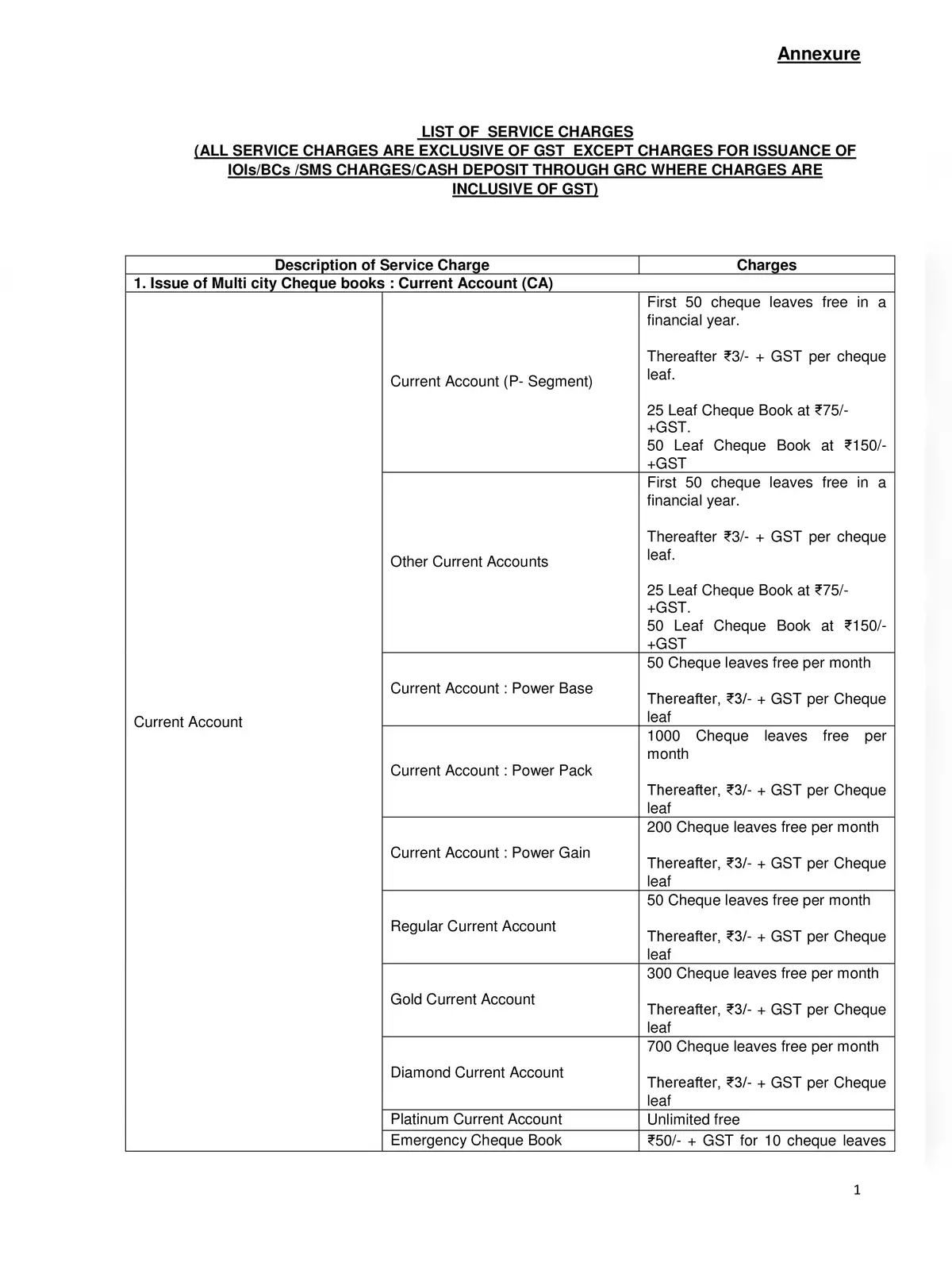

- Chequebook charges

- Charges on Non-Financial Transactions

- Cash Withdrawal at SBI ATM

- Cash Withdrawal at SBI Branches

- Doorstep Banking Services

Understanding the Service Charges by SBI Bank

The service charges by SBI Bank are fees that the bank adds for specific services. For example, customers are charged fees for using ATMs that are not part of the SBI network, which can also be called a consumer service fee or maintenance fee. Generally, banks apply service fees that go beyond the basic costs of their products or maintaining customer relationships.

To keep informed about the latest service charges by SBI Bank, you can easily download the List of Service Charges PDF by SBI Bank through the link below. This handy resource provides essential information to help you manage banking fees effectively. 📑💳✨