Kotak RTGS Form - Summary

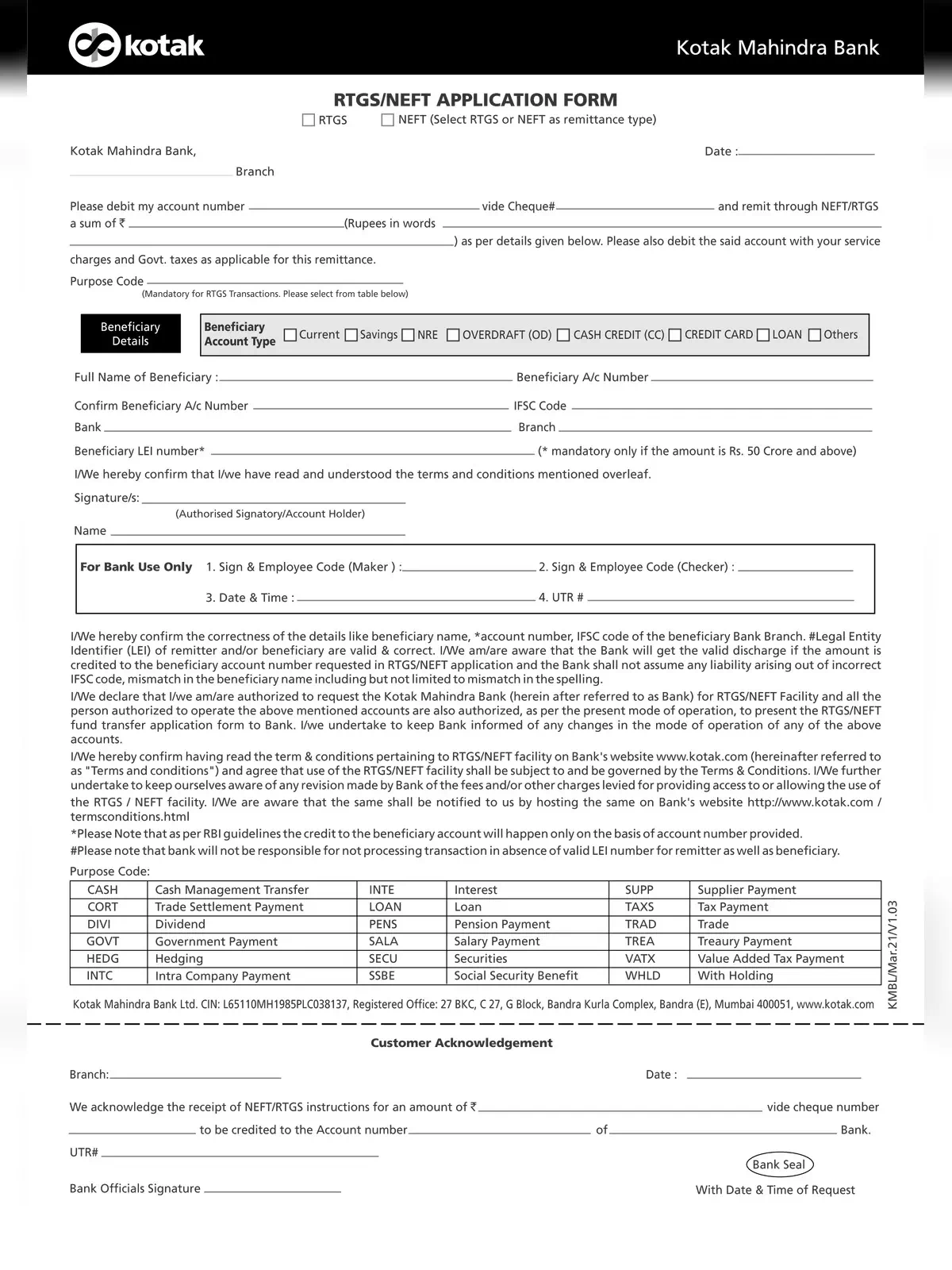

Kotak RTGS form is used to transfer money from one bank account to another quickly and safely. RTGS stands for Real-Time Gross Settlement, which means the money moves instantly and directly between accounts without any delay. This form helps you give all the details needed for the bank to process your payment correctly.

Using the Kotak RTGS form is easy. You need to fill in information like the sender’s account number, the receiver’s account number, the bank name, branch, IFSC code, and the amount to transfer. Once submitted, the bank processes your request immediately, making it a fast way to send large amounts of money.

Kotak Bank RTGS Form – Highlights

| Type of Form | Kotak Bank RTGS/NEFT Application Form |

| Name of Bank | Kotak Bank |

| Official Website | www.kotak.com |

| Uses of Form | Online Transfer of Funds |

| Minimum Limit | The minimum limit is Rs. 2 lakhs for RTGS, No minimum limit for NEFT |

| Maximum Limit | No limit |

| Beneficiary | Bank Customers |

| Form Language | English, Hindi |

| Kotak Bank RTGS Form PDF | Download PDF |

Details to be mentioned in the RTGS Form

- On the bank RTGS form, there are two sections where each is defined differently. In the top section, the applicant should enter beneficiary details and, in the next part, enter the remitter details.

- Remitter Bank Account Details

- Beneficiary Bank Account Details

- Cheque leaf details

- Amount

- Date

- Mobile & E-mail ID

- And any other details

Documents Required for Kotak Bank RTGS Form

- Application Form

- Cheque Leaf of Remitter

- Remitter Details

- Beneficiary Details

- And any other details

You can download the Kotak Mahindra Bank RTGS/NEFT Application Form in PDF format using the link given below.