HDFC Bank Credit Cards Revised Terms & Conditions - Summary

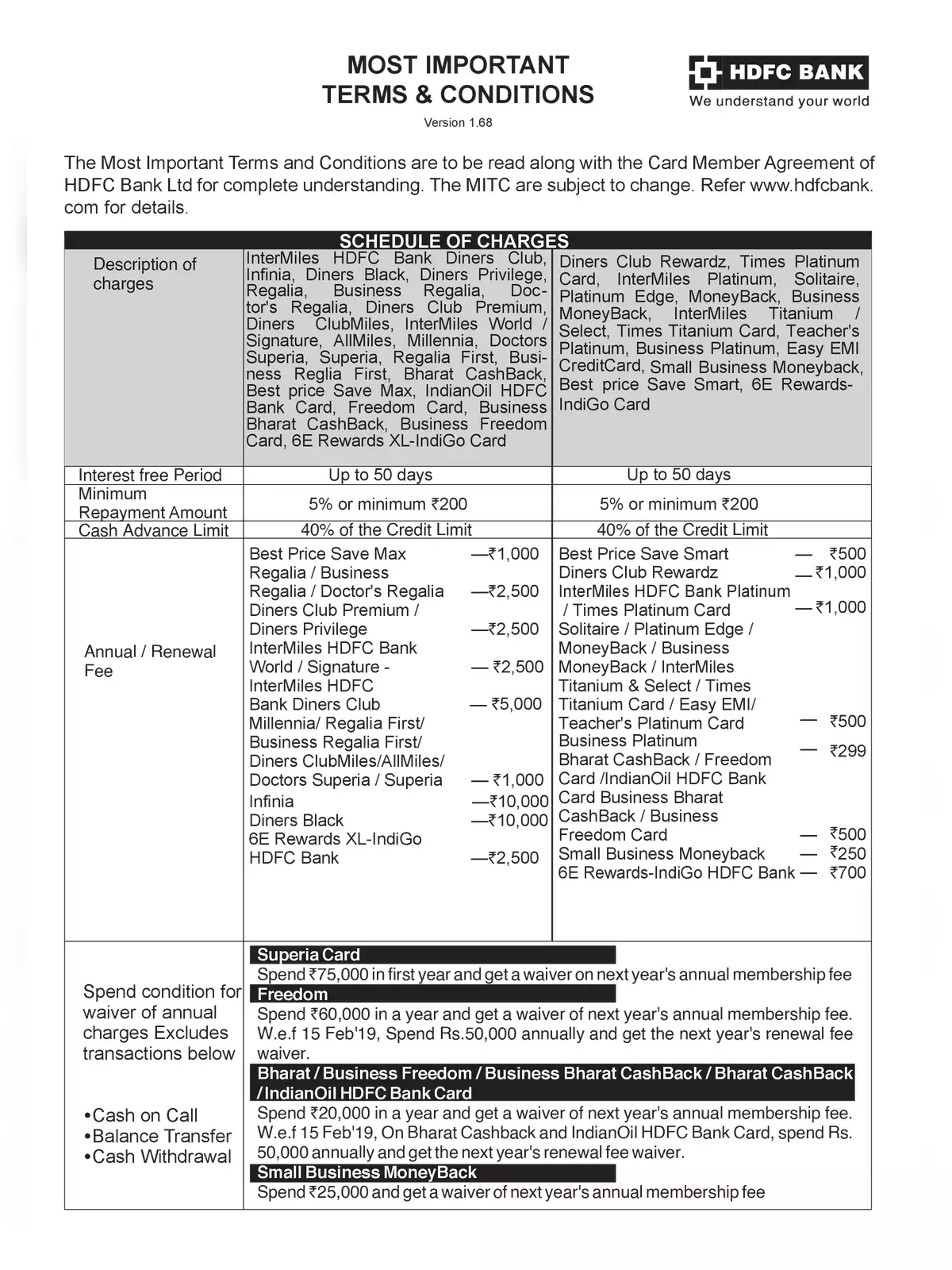

The most important terms and conditions for HDFC Bank credit cards should be read with the Card Member Agreement of HDFC Bank Ltd to ensure complete understanding. The MITC is subject to change.

Key Features of HDFC Bank Credit Cards

- Interest-free Period: Up to 50 days

- Minimum Repayment Amount: 5% or minimum ₹200

- Cash Advance Limit: 40% of the Credit Limit

Card members can use the HDFC Bank credit card to access cash during emergencies from ATMs in India or abroad. There is a transaction fee of 2.5% (minimum ₹500, excluding Infinia) on the amount withdrawn, which will be billed in the next statement. This transaction fee is subject to change at the discretion of HDFC Bank. Please note that all cash advances will also incur a finance charge similar to the charges on revolving credit (for details, please refer to the schedule of charges) from the withdrawal date until full payment is made. The finance charge may change at HDFC Bank’s discretion.

Download the Revised Terms & Conditions

For more comprehensive information, you can download the HDFC Bank Credit Cards Revised Terms & Conditions in PDF format using the link provided below. It’s important to stay informed about these terms when using your credit card!