Form 15 H - Summary

Form 15H is a self-declaration form specifically created for individuals over 60 years of age, allowing them to save on Tax Deducted at Source (TDS) from the interest income earned on fixed deposits. If you wish to apply for no or reduced TDS on your fixed deposits, it is essential to submit this form to your bank.

This form is valid for one financial year, so remember to submit it at the beginning of each financial year. By doing this, you can ensure that your bank won’t deduct any TDS on the interest income you earn.

Understanding Form 15H

Key Information Needed

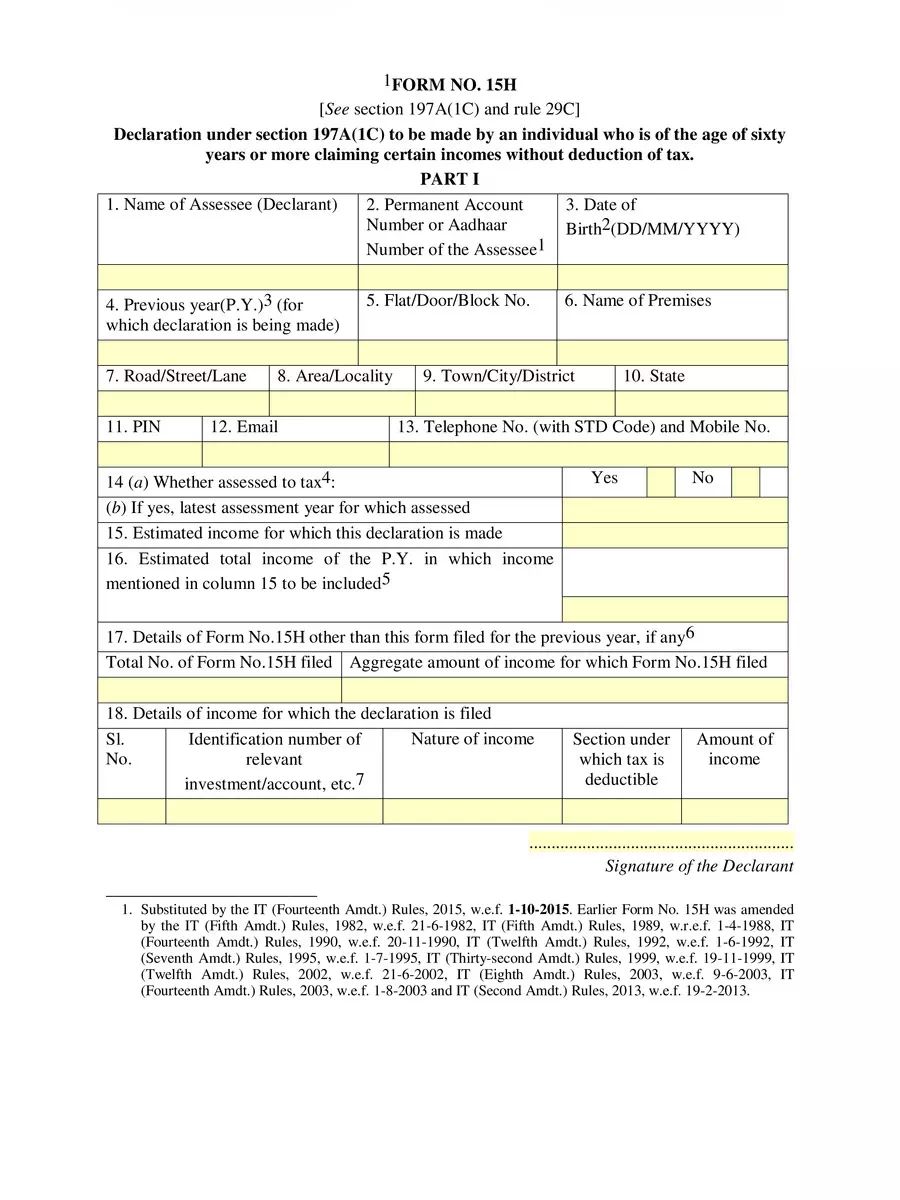

- Name of Assessee (Declarant) – Write your name as per your income tax records along with your PAN number.

- Status – Clearly state if you are an individual or a Hindu Undivided Family (HUF).

- Previous Year – Specify the current financial year for which you are completing the form.

- Residential Status – This form is only for residents of India.

- Full Address – Provide your complete address, including PIN code, email, and phone number.

- Have you been assessed to tax under the Income Tax Act, 1961? – Reply with ‘yes’ if your income exceeded the taxable limit in any of the last six years.

- If yes, state the latest assessment year for which you were assessed – Mention the most recent year when your income was above the taxable limit.

- Estimated income for which the declaration is made – Share the total interest or other income for which TDS should not be deducted.

- Estimated total income of the previous year including the income mentioned above – Calculate your total income from all sources, including salary, interest income, and any other earnings, incorporating the previously mentioned income.

- Details of Form 15G filed during the previous year, if applicable – Indicate the total number of Form 15G submissions made for that year.

- Aggregate amount of income for which Form 15G was submitted – Provide the total income for which Form 15G was filed.

- Full details of income for which declaration is filed, including identification numbers of relevant investments/accounts, nature of income, section under which tax is deductible, and amount of income – List your fixed deposit account number, recurring deposit details, NSC details, life insurance policy numbers, etc. (many of these fall under taxation as per section 56 of the Income Tax Act).

- Signatures – Indicate your capacity if signing on behalf of an HUF or Association of Persons (AOP).

You can easily download the Form 15 H in PDF format using the link provided below.