Form 10CB Certificate of Accountant - Summary

Form 10CB Certificate of Accountant is an important document needed for tax purposes in India. This PDF is essential for anyone looking to understand the significance of Form 10CB and how to obtain it. You can download it below.

Understanding Form 10CB

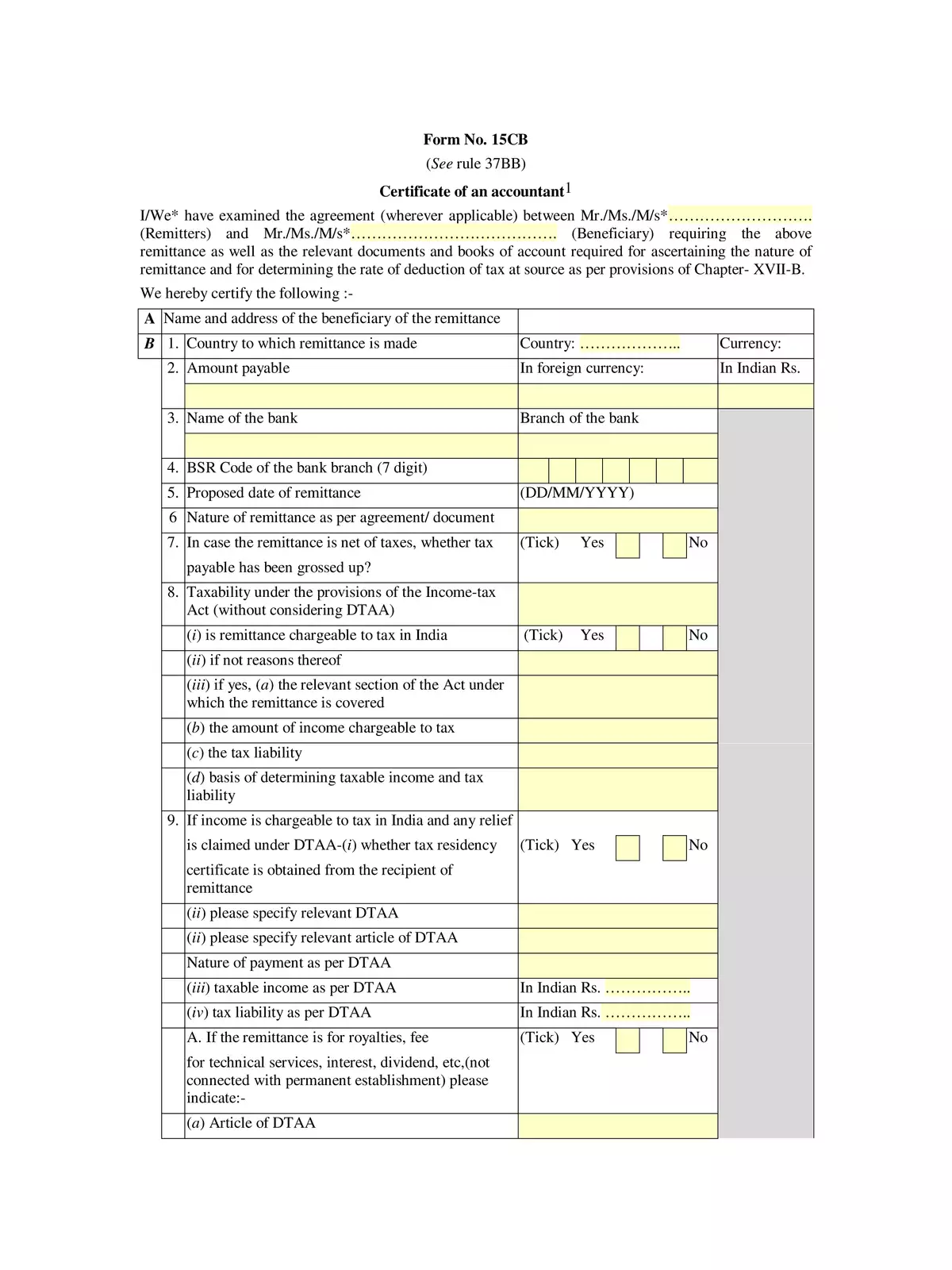

Form 10CB is a certificate issued by a Chartered Accountant. It plays a vital role in the process of filing your taxes, especially when you’re dealing with foreign remittances. If you’re planning to send money abroad, you must have this form ready to ensure everything is compliant with Indian tax laws.

How to Obtain Form 10CB

To get Form 10CB, you need to approach a Chartered Accountant (CA). The CA will help you fill out the required details accurately. When applying for this certificate, be prepared with all necessary documents, as it helps the CA to assess your financial situation appropriately.

Form 10CB essentially confirms that taxes have been deducted and helps in the smooth processing of your foreign payments. It’s a good idea to download the PDF provided below to learn more about its importance and steps to fill it out properly.

For those looking to expand their knowledge, understanding the connection between Form 10CB and Form 15CA is crucial. While Form 15CA contains details of the remittance, Form 10CB acts as a verification certificate from the accountant.

Make sure you keep this document safe as you might need it for future references during tax filing. It’s also advisable to consult your CA regarding any changes in regulations or requirements.

Don’t forget to download the PDF for more detailed insights!