DPT-3 Form - Summary

As part of the Companies (Acceptance of Deposits) Amendment Rules, 2019, every company is required to file the DPT-3 Form, which serves as a one-time return for outstanding loans that are not classified as deposits. This filing is crucial and must be completed within 90 days from the end of the Financial Year 2022-23.

Importance of the DPT-3 Form

Every company, excluding Government Companies, needs to submit the DPT-3 Form for outstanding loans it has received, which do not fall under the category of deposits. This adherence is in line with the recent amendments set forth by the Ministry of Corporate Affairs (MCA).

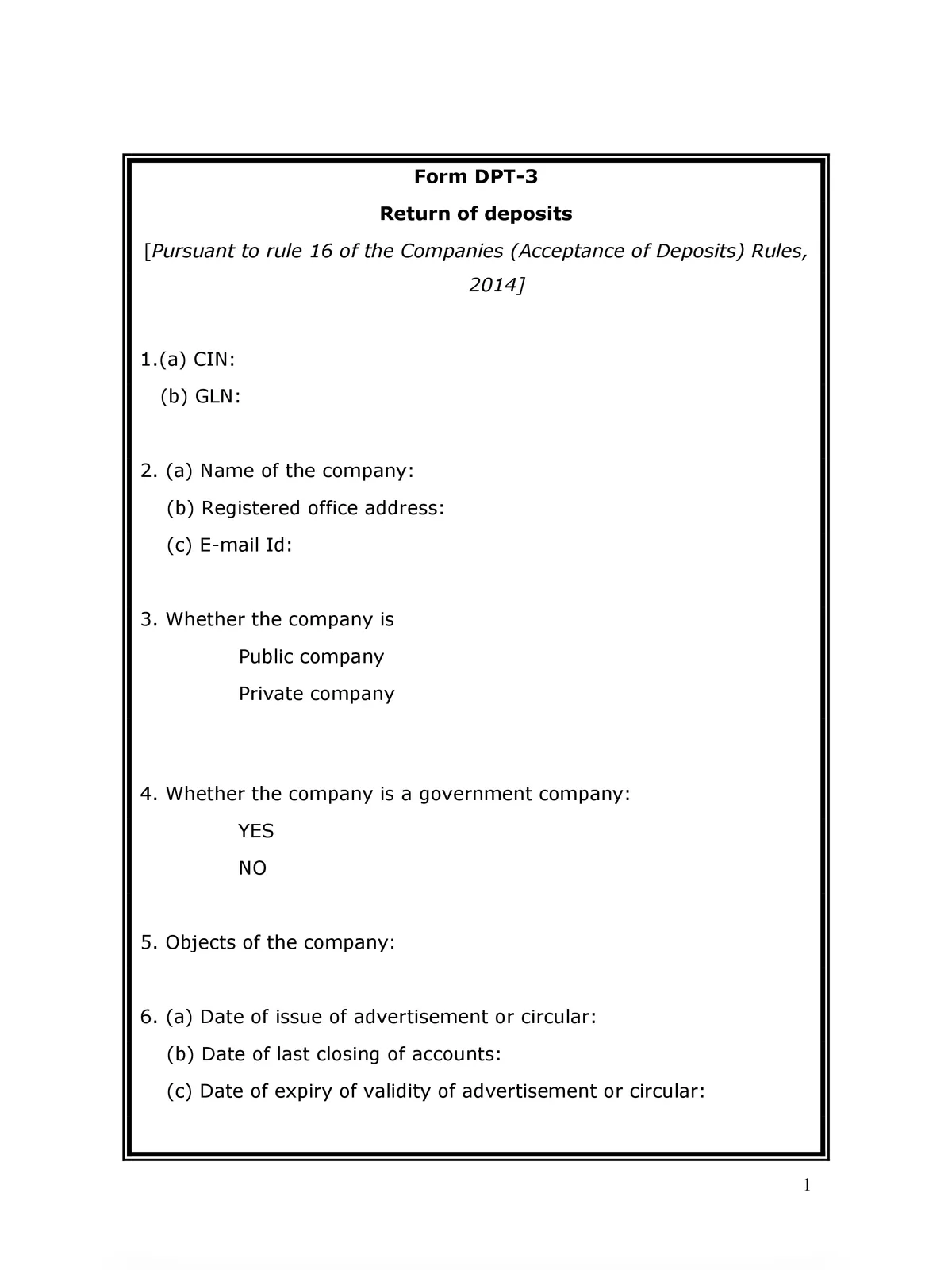

Understanding the DPT-3 Form

All companies, apart from Government entities, are mandated to file a one-time return concerning money received or loans that do not qualify as deposits. According to clause (c) of sub-rule 1 of rule 2, this requirement covers the period from 1st April 2014 until the official publication date of this notification. Companies must complete the DPT-3 Form within ninety days from the date of publication and pay any necessary fees as specified in the Companies (Registration Offices and Fees) Rules, 2014.

Please note that all outstanding loans or money received from 1st April 2014 up to 22nd January 2019 must be included in the DPT-3 Form submission.

Who Needs to File the DPT-3 Form?

- Based on rule 16A, all companies that have received loans and have outstanding amounts must file the DPT-3 Form.

- This requirement applies to all types of companies including small, private, non-small, and OPCs.

- Both secured and unsecured loans, as well as advances made for goods and services, need to be reported in the DPT-3 Form.

- Even if a Holding Company, Subsidiary Company, or Associate Company has received a loan, it must file the DPT-3 Form.

- If a company holds a loan that was taken before 1st April 2014 and is still active, it must report this to the ROC via the DPT-3 Form.

You can download the DPT-3 Form PDF using the link given below.