Bank of Baroda Form 60 - Summary

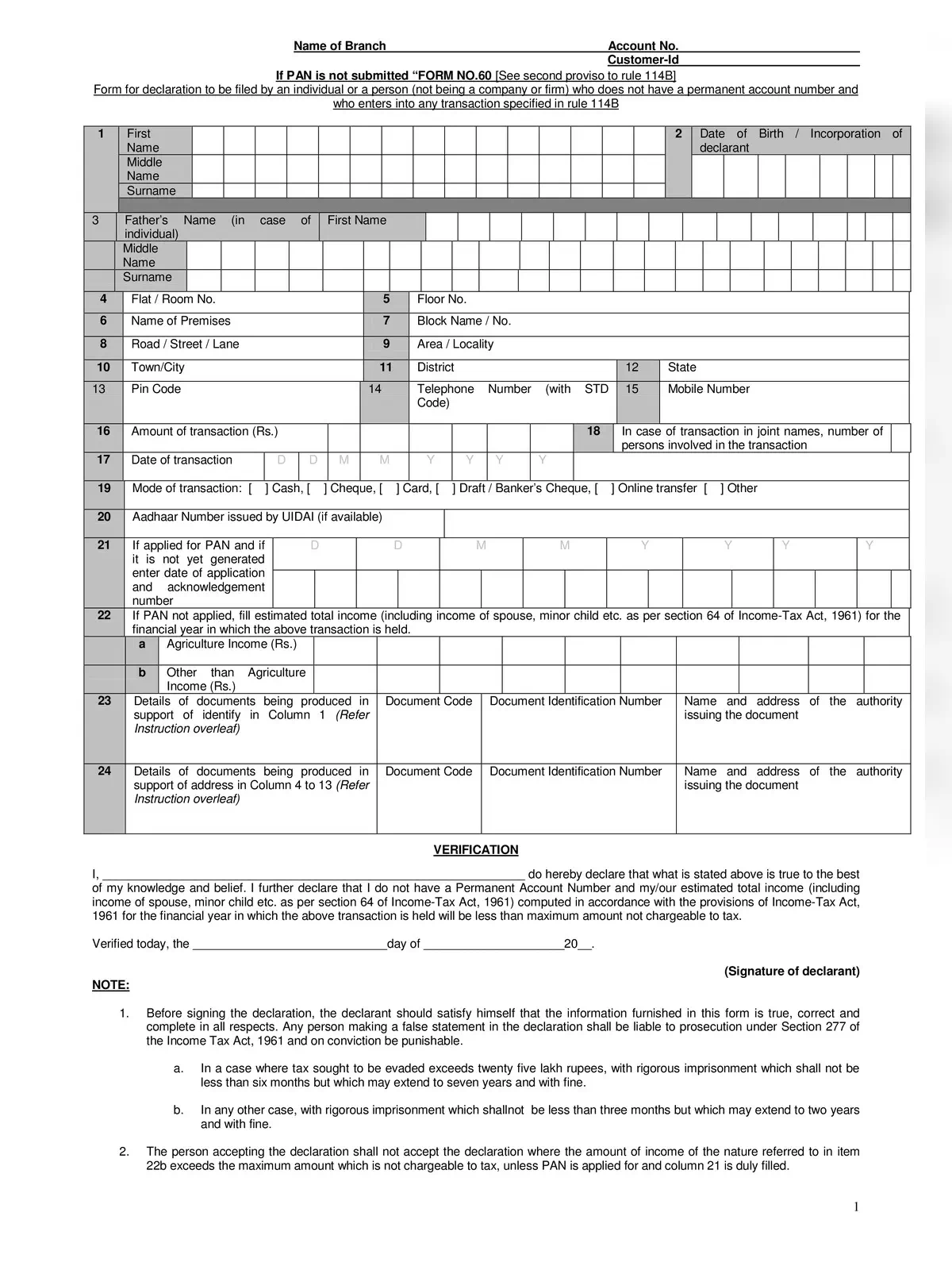

Are you looking for the Bank of Baroda Form 60? This form is very important if you don’t have a Permanent Account Number (PAN) but need to do certain transactions. You can easily get the Bank of Baroda Form 60 PDF from the official Bank of Baroda website (https://www.bankofbaroda.in/) or download it directly using the link below on this page. This document helps you make declarations as required by the rules.

Overview of Bank of Baroda Form 60

The Bank of Baroda Form 60 is made for individuals (not companies or businesses) who are doing certain transactions but don’t have a PAN card. It’s like a promise you make under rule 114B of the Income Tax rules in India. By using this form, you are making sure you follow the government’s rules about tracking money matters, even without a PAN.

What Information Do You Need to Fill in Bank of Baroda Form 60 PDF?

When you fill out the Bank of Baroda Form 60 PDF, you need to provide some details:

- Your personal information, like your name and address.

- The amount involved in the transaction.

- How you are paying or receiving the money (like cash, cheque, or online).

- If you have an Aadhaar card from UIDAI, include your Aadhaar number.

- If you have applied for a PAN card but haven’t received it yet, write the date you applied and the number you got as proof.

- List the documents you use to prove your identity, following the guidelines.

Documents You May Need to Submit with Bank of Baroda Form 60

If you don’t have your PAN yet but have applied, you should provide a copy of one of these papers along with your Bank of Baroda Form 60. These papers help prove who you are or where you live:

- Your Aadhaar Card.

- Your Driving License.

- Your Passport.

- Your Ration Card.

- ID proof from a government-recognized place.

- A copy of your electricity or telephone bill.

- Any document given by the Central, State, or local government.

- Any other document accepted as proof for the address you’ve written on the form.

Why Filling Form 60 Matters: You must fill and submit this form for certain transactions if you don’t have a PAN or are waiting for your PAN card. It helps authorities keep track of transactions.

Transactions That Need Bank of Baroda Form 60

Here are the types of transactions where you must submit the Bank of Baroda Form 60 if you don’t have a PAN:

| Type of Transaction | Transaction Amount |

|---|---|

| Buying or selling any car, jeep, or other motor vehicle (excluding bikes or scooters) | Any amount, no matter how small or large. |

| Opening an account for shares and stocks (demat account) | Any amount. |

| Starting a new bank account (except for a basic savings account) or asking for a debit/credit card | Any amount. |

| Buying or selling a house, land, or building | If the value is ₹10 lakh or more. |

| Putting money in a fixed deposit with banks, post offices, Nidhi companies, or NBFCs | If a single deposit is more than ₹50,000 or all your deposits in the tax year total more than ₹5 lakh. |

| Paying cash for food or stay at restaurants or hotels | If the bill is more than ₹50,000 at one time. |

| Paying cash when you travel outside India or buying foreign currency | If you pay more than ₹50,000 at once. |

| Paying money for life insurance | If you pay more than ₹50,000 in a year. |

| Selling or buying shares of companies or other securities | If the money for one deal is more than ₹1 lakh. |

| Selling or buying other goods or services | If the money for one deal is more than ₹2 lakh. |

| Paying money to Mutual Funds when you buy their units | If you pay more than ₹50,000. |

You can download the Bank of Baroda Form 60 PDF right now using the direct link below. Fill it out and submit it whenever you do the required transaction. This form is for the year 2025 and helps you easily manage your transactions according to the rules.