Form 10E Claim Relief Under Section 89(1) - Summary

Income Tax Form 10E is crucial for anyone wanting to save taxes on income from arrears, as outlined in Section 89(1) of the Income Tax Act of 1961. In this article, we will delve into Form 10E and how it can help you reduce your tax obligations through an easy filing process.

When you receive salary or pension in arrears, it can impact your tax situation a lot. You may worry that this will move you into a higher tax slab or that you will have to pay more taxes in the year you get the arrears than you would have in the previous year. To protect you from an unjust tax burden due to delayed income, the tax laws provide relief under Section 89(1). You can claim this relief in your income tax return if you have received any part of your salary in arrears.

Understanding the Importance of Form 10E

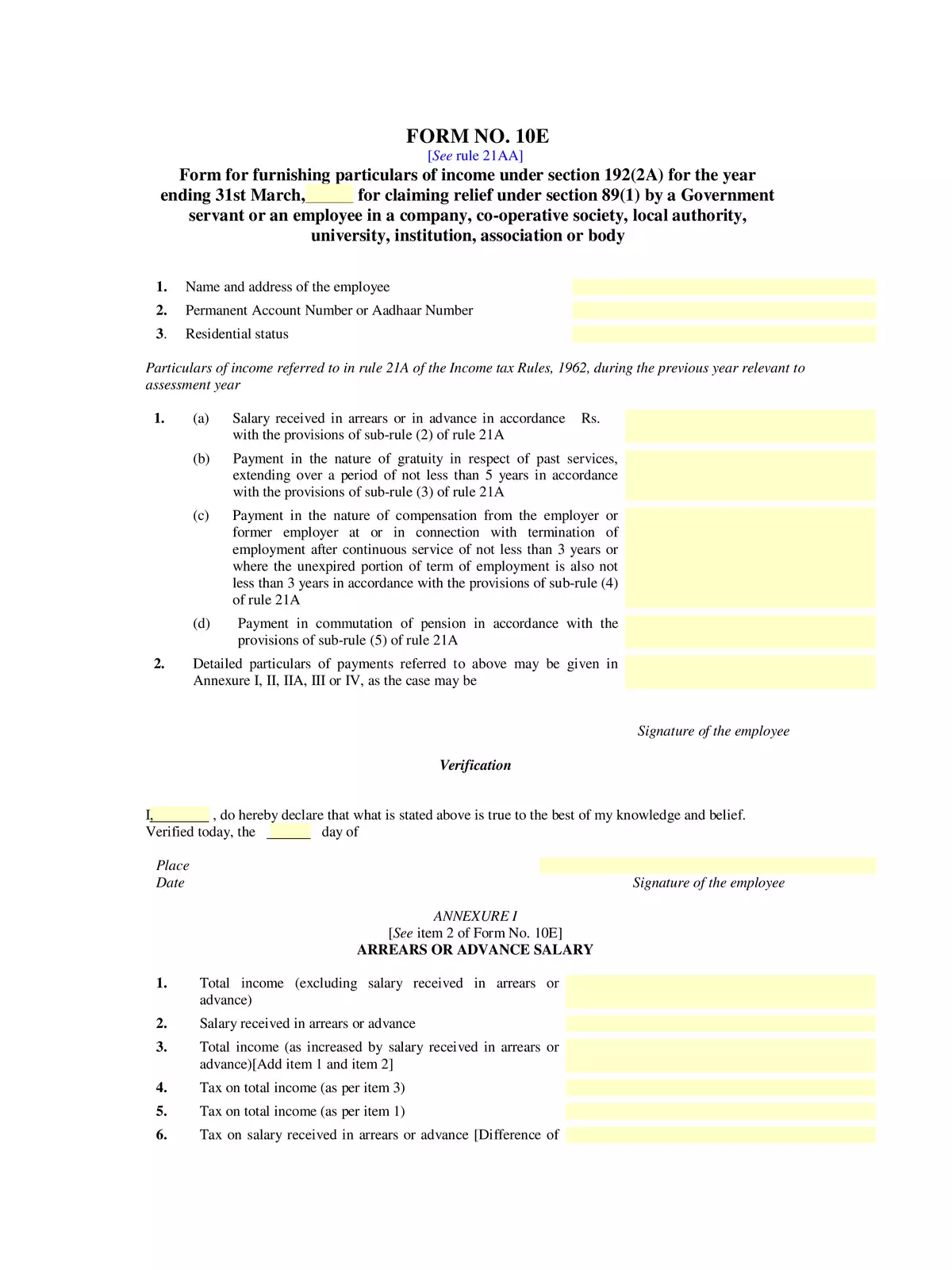

To claim relief under Section 89(1), the Income Tax Department requires you to file Form 10E. This section offers tax relief by recalculating your tax for the year when you received the arrears and the year to which those arrears apply. Essentially, your taxes will be adjusted as if the arrears were received in the year they were originally due, thereby helping you save on your tax bill.

Steps to Download Form 10E

For your convenience, you can easily download the Form 10E Claim Relief Under Section 89(1) in PDF format using the link below. Just click the link to access your PDF file and follow the instructions provided to complete it correctly.

Don’t let the worry of high taxes hold you back! Use Form 10E to manage your tax duties wisely. 😊