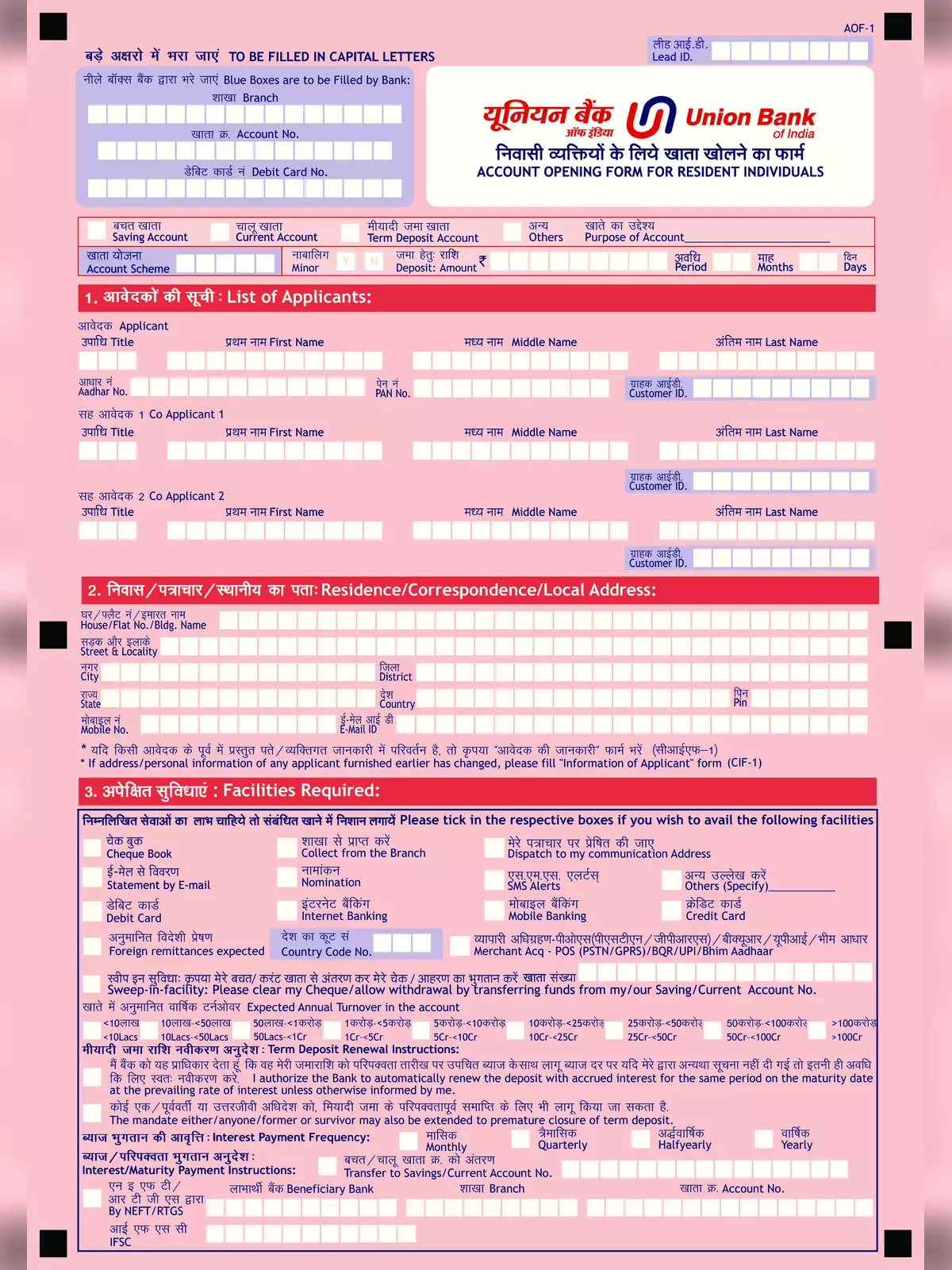

Union Bank Account Opening Form - Summary

This is an application form for Saving account opening form for Individual and this form can be obtained from the nearest branch of Union Bank, or it can be directly download from the link given below.

Documents Required

- Two Self-Attested passport size photographs.

- Attested copies of ID Proofs, Address proof and additional proof

- Amount Required for Saving account open

- And ant other documents.

Steps to Open a Savings Account with Union Bank of India

- Visit the Union Bank branch closest to you.

- Request the bank executive for an account opening form.

- On the account opening form, applicants will have to fill in both the parts.

- Form 1 – Name, address, signature, various other details and assets.

- Form 2 – Customers will have to fill in this part if they do not have a PAN card.

- Ensure that all the fields have been entered and are correct. The details mentioned in the application form should match those mentioned in the KYC documents that have been submitted.

- The customer will now have to make an initial deposit of Rs.1,000.

- As soon as the bank completes the verification process, the account holder will be granted a free passbook and cheque book.

- Simultaneously, customers can submit the internet banking form.

Any Resident Individual – Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Visually Impaired persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc.

- Minimum balance requirement with or without cheque book facility:

Centers Without Cheque Book (`)

With Cheque Book (`)

Metro 500

1000

Urban 500

1000

Semi-Urban 250

500

Rural 100

250

- Interest is calculated on a daily product basis and will be credited on a quarterly basis in the months of April, July, October, and January every year.

- Rate of interest up to 25Lacs and more than 25 lacs-3%p.a

Features:

- Eligibility: All customers who are drawing pension through our Bank or intend to draw pension through our Banks are eligible to open specially designed pension account under scheme code SBPEN.

- Prompt Disbursal of pensions to the pensioners.

- DA increases are given promptly.

- Interest is calculated on a daily product basis and will be credited on a quarterly basis in the months of April, July, October, and January every year.

- Rate of interest up to 25 lacs – 3.25% p.a. and more than 25 lacs 4% p.a.