Form 29B for Report under section 115JB of the Income-tax Act, 1961 - Summary

Form 29B: Essential Report under Section 115JB of the Income-tax Act, 1961

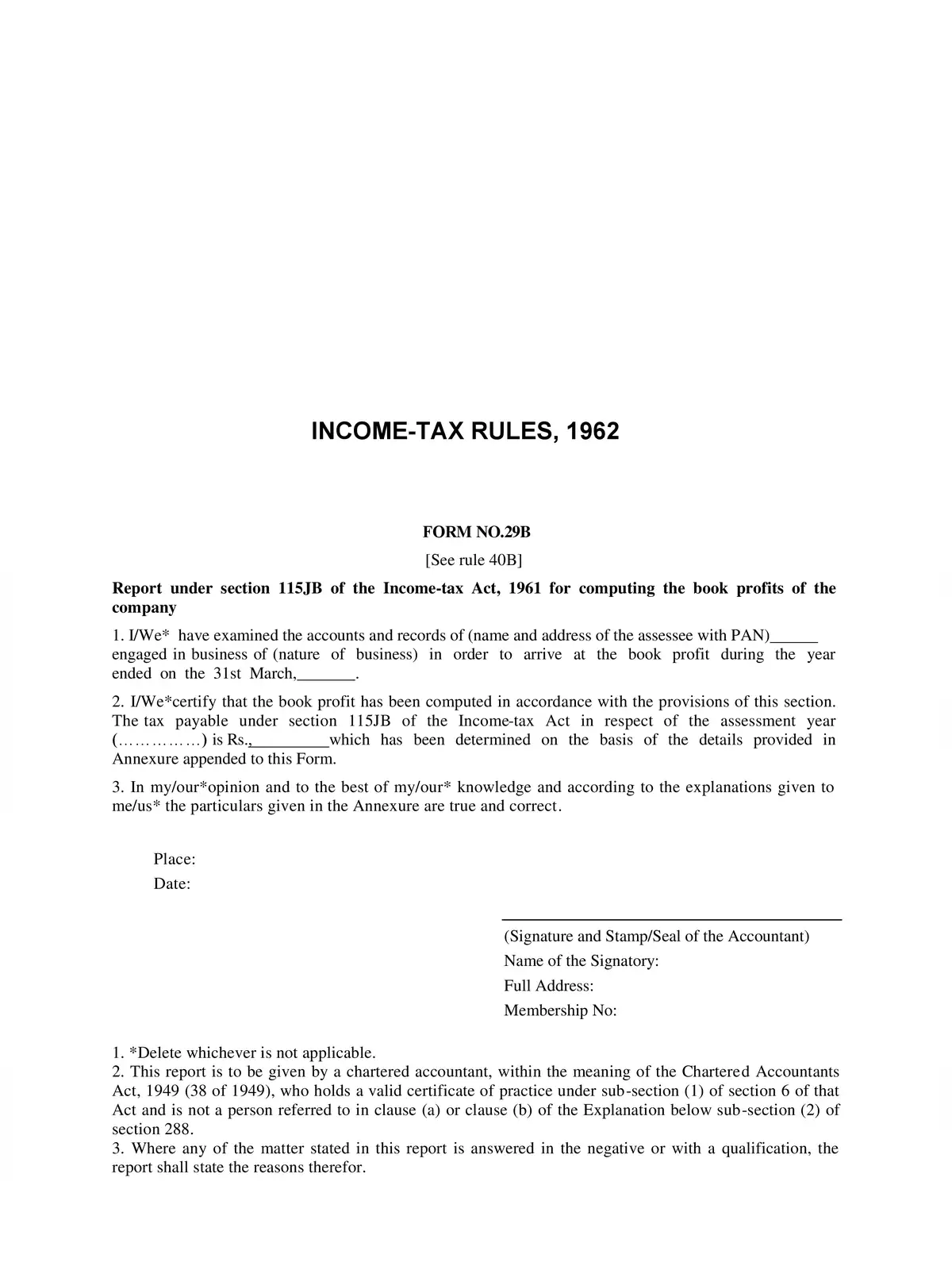

The Form 29B report under section 115JB of the Income-tax Act, 1961 is crucial for computing the book profits of a company. This report plays a significant role in ensuring compliance with the Income-tax regulations in India. 📊

Understanding Form 29B is vital for businesses aiming to adhere to the guidelines set forth by the Income-tax Department. This reporting format helps in determining the minimum alternate tax (MAT) applicable to companies, ensuring they pay taxes on their book profits rather than their taxable income. By reporting the correct figures in Form 29B, companies can avoid penalties and ensure smooth operations.

Importance of Form 29B in Financial Reporting

Filing Form 29B accurately is not just a regulatory obligation; it also reflects the financial health of the company. Investors and stakeholders often scrutinise these reports to gauge the company’s profitability and compliance with tax laws. Thus, having a well-prepared Form 29B is essential for maintaining investor confidence and securing funding. 💼

Moreover, with the increasing emphasis on transparency in financial reporting, companies must ensure that the Form 29B is meticulously prepared and submitted. This is where professional help may come into play, as experts can guide businesses through the intricacies of the computation and reporting process.

In summary, the Form 29B report under section 115JB of the Income-tax Act, 1961 is indispensable for companies seeking clarity and compliance in their financial affairs. For further understanding and detailed insights, you can download the report in PDF format. 📥