EPF Return Form 11 (Self Declaration Form) - Summary

EPF form 11 is a crucial self-declaration form that every employee must fill out and submit when they join a new company that provides the EPF Scheme (Employees Provident Fund). This form captures the EPF history of the employee and is mandatory for submission at the time of joining an organization.

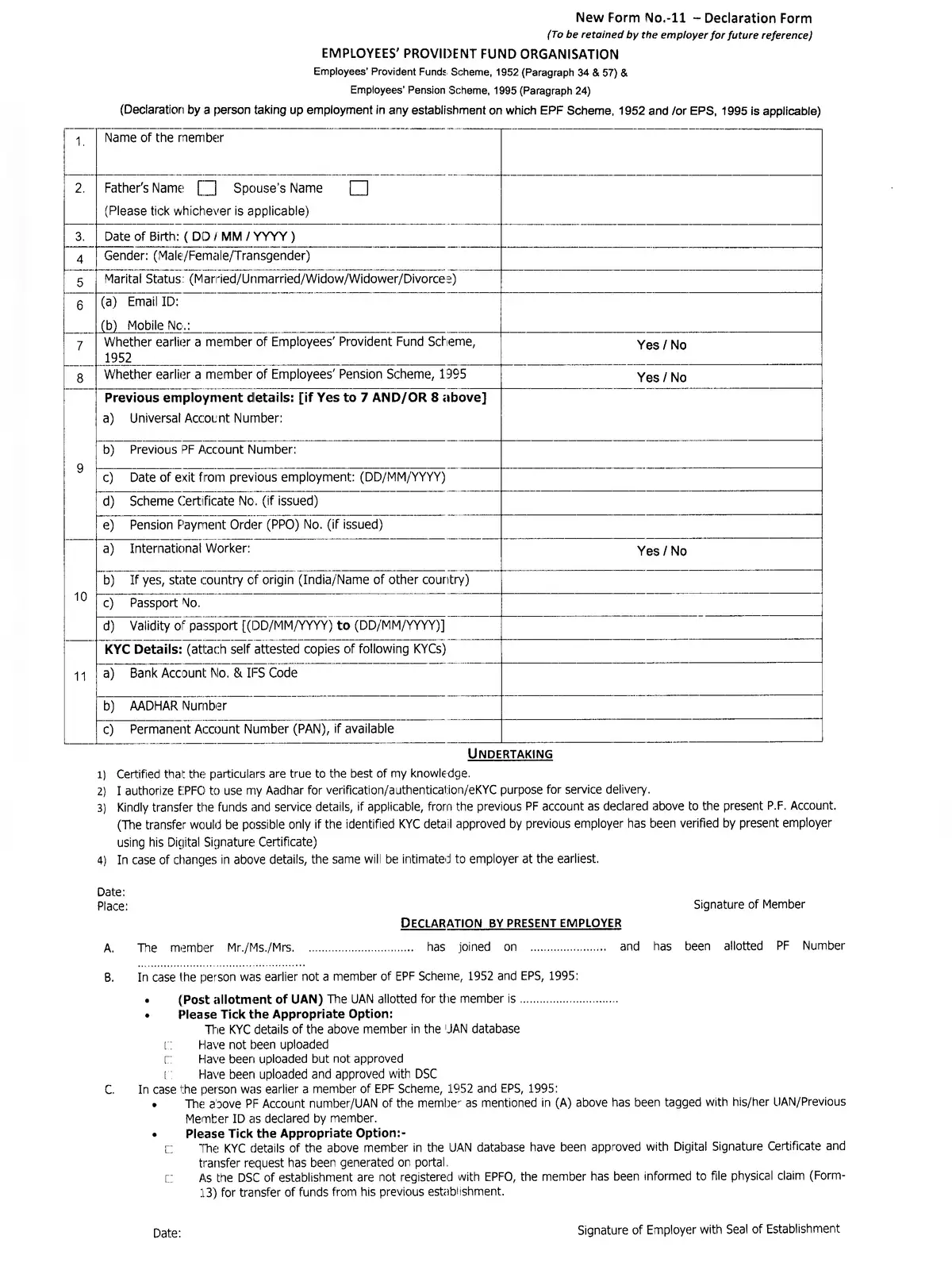

Understanding the EPF Return Form 11

Filling out this form accurately is important as it helps in ensuring that your EPF details are correctly updated. Here’s what you need to know about the EPF Return Form 11 and the details required.

EPF Return Form 11 (Required Details)

- Name of the member

- Father’s name or Spouse’s name

- Date of birth

- Gender

- Marital status

- Email ID

- Mobile

- Whether earlier a member of Employees’ Provident Fund Scheme, 1952

- Whether earlier a member of Employees’ Pension Scheme, 1995

- Previous employment details: [if Yes to 7 AND/OR 8 above]

- a) Universal Account Number:

- b) Previous PF Account Number:

- c) Date of exit from previous employment: (DD/MM/YYYY)

- d) Scheme Certificate No. (if issued)

- e) Pension Payment Order (PPO) No. (if issued)

- a) International Worker:

- b) If yes, state country of origin (India/Name of other country)

- c) Passport No.

- d) Validity of passport [(DD/MM/YYYY) to (DD/MM/YYYY)]

- KYC Details: (attach self-attested copies of the following KYCs)

- a) Bank Account No. & IFS Code

- b) AADHAR Number

- c) Permanent Account Number (PAN), if available

- Signature of the member

Download the EPF Return Form 11 (Self Declaration Form) in PDF format using the link given below or an alternative link for easy access. Whether you’re starting a new job or updating your details, this form is essential for maintaining your EPF records. Don’t forget to download the PDF for your convenience! 📄