GST Rate Change Notification 2026 - Summary

GST (Goods and Services Tax) rate change notification is an official update issued by the government to inform businesses and taxpayers about any changes in tax rates on goods and services. These notifications help businesses understand the new rates they need to apply while selling products or providing services.

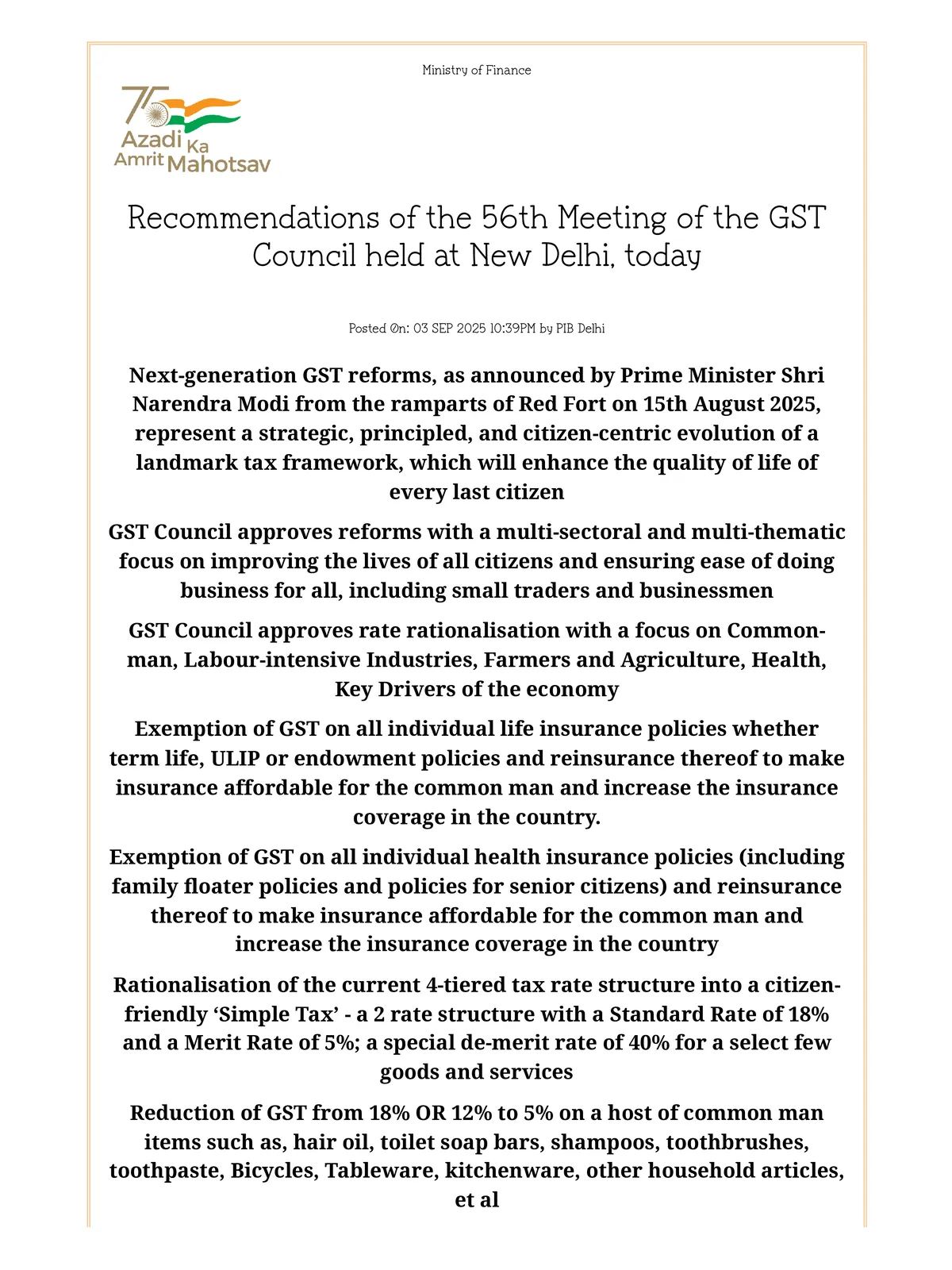

GST Council approves reforms with a multi-sectoral and multi-thematic focus on improving the lives of all citizens and ensuring ease of doing business for all, including small traders and businessmen.

GST Rate Change Notification 2025 or GST 2.0 Reform Notification

- Exemption of GST on all individual life insurance policies (term life, ULIP, endowment) and reinsurance to make insurance affordable and increase coverage.

- Exemption of GST on all individual health insurance policies (including family floater and senior citizen policies) and reinsurance to make insurance affordable and increase coverage.

- Rationalisation of the 4-tiered tax structure into a citizen-friendly ‘Simple Tax’ with:

- Standard Rate: 18%

- Merit Rate: 5%

- Special de-merit Rate: 40% for select goods/services

- Reduction of GST from 18% or 12% to 5% on common items like hair oil, toilet soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles.

- Reduction of GST from 5% to NIL on UHT milk, prepackaged/labeled chena or paneer, and all Indian breads (chapati, roti, paratha, parotta, etc.).

- Reduction of GST from 12% or 18% to 5% on packaged namkeens, bhujia, sauces, pasta, instant noodles, chocolates, coffee, preserved meat, cornflakes, butter, ghee, etc.

- Reduction of GST from 28% to 18% on air-conditioning machines, TVs (≤32 inch), dishwashing machines, small cars, and motorcycles ≤350cc.

- Reduction of GST from 12% to 5% on agricultural goods, including tractors, agricultural/horticultural/forestry machinery for soil preparation, cultivation, harvesting, threshing, balers, mowers, composting machines, etc.

- Reduction of GST from 12% to 5% on labor-intensive goods like handicrafts, marble/travertine blocks, granite blocks, and intermediate leather goods.

- Reduction of GST from 28% to 18% on cement.

- Reduction of GST from 12% to NIL on 33 lifesaving drugs/medicines and from 5% to NIL on 3 lifesaving drugs used for cancer, rare diseases, and severe chronic diseases.

- Reduction of GST on all other drugs and medicines from 12% to 5%.

- Reduction of GST from 18% to 5% on medical apparatus and devices used for medical, surgical, dental, veterinary, or physical/chemical analysis.

- Reduction of GST from 12% to 5% on medical equipment and supply devices such as wadding gauze, bandages, diagnostic kits, reagents, blood glucose monitors, and other medical devices.

- Reduction of GST from 28% to 18% on small cars and motorcycles ≤350cc.

- Reduction of GST from 28% to 18% on buses, trucks, ambulances, etc.

- Uniform GST rate of 18% on all auto parts regardless of HS code.

- Reduction of GST on three-wheelers from 28% to 18%.

- Correction of inverted duty structure in manmade textile sector:

- Manmade fibre: 18% → 5%

- Manmade yarn: 12% → 5%

- Correction of inverted duty structure in fertilizer sector: GST on sulphuric acid, nitric acid, ammonia reduced from 18% to 5%.

- Reduction of GST from 12% to 5% on renewable energy devices and parts for their manufacture.

- Reduction of GST from 12% to 5% on hotel accommodation services valued ≤ Rs. 7,500 per unit per day.

- Reduction of GST from 18% to 5% on beauty and physical well-being services for the common man, including gyms, salons, barbers, yoga centers, etc.