Economic Survey 2020-21 - Summary

Finance minister Nirmala Sitharaman will present the Economic Survey 2020-21 in Parliament on Friday as the Budget Session is all set to begin. The Budget will be presented on February 1. Generally, the Economic Survey is presented a day before the Budget, but this year as the Budget follows the weekend, the Economic Survey will be presented earlier than usual. Chief Economic Adviser KV Subramanian will address a press conference at 2.30pm after the presentation of the Economic Survey.

This year, it holds major significance because of the economic upheavals owing to Covid-19 pandemic. It will also project India’s gross domestic product growth for 2021-22. As the Budget session has gone paperless this year, all the documents, including the Economic Survey, would be made available online soon after the authenticated copies are laid on the Table of the House, the Lok Sabha Secretariat has said. The copy of the Economic Survey can be downloaded from www.indiabudget.gov.in.

Economic Survey 2020-21

The Economic Survey is a crucial document not only for GDP projection. Every year, it has a theme and since 2018 CEA Subramanian has grabbed attention with his innovations. In 2019, the entire Economic Survey was printed in pink, carrying a message for women empowerment and gender equality.

The Economic Survey 2020-21 is a result of teamwork and collaboration. The Survey has benefited from the

comments and insights of the Hon’ble Finance Minister Smt. Nirmala Sitharaman and Hon’ble Minister of State

for Finance Shri. Anurag Singh Thakur. The Survey has also benefited from the comments and inputs of various

officials, specifically Tarun Bajaj, T. V. Somanathan, Rajiv Kumar, Shekhar C. Mande, Renu Swarup, Ashutosh

Sharma, Prof. K. Vijay Raghavan, Guruprasad Mohapatra, Ajay Prakash Sawhney, A.K. Sharma and Indu Bhushan.

Key Highlights of Economic Survey 2020-21

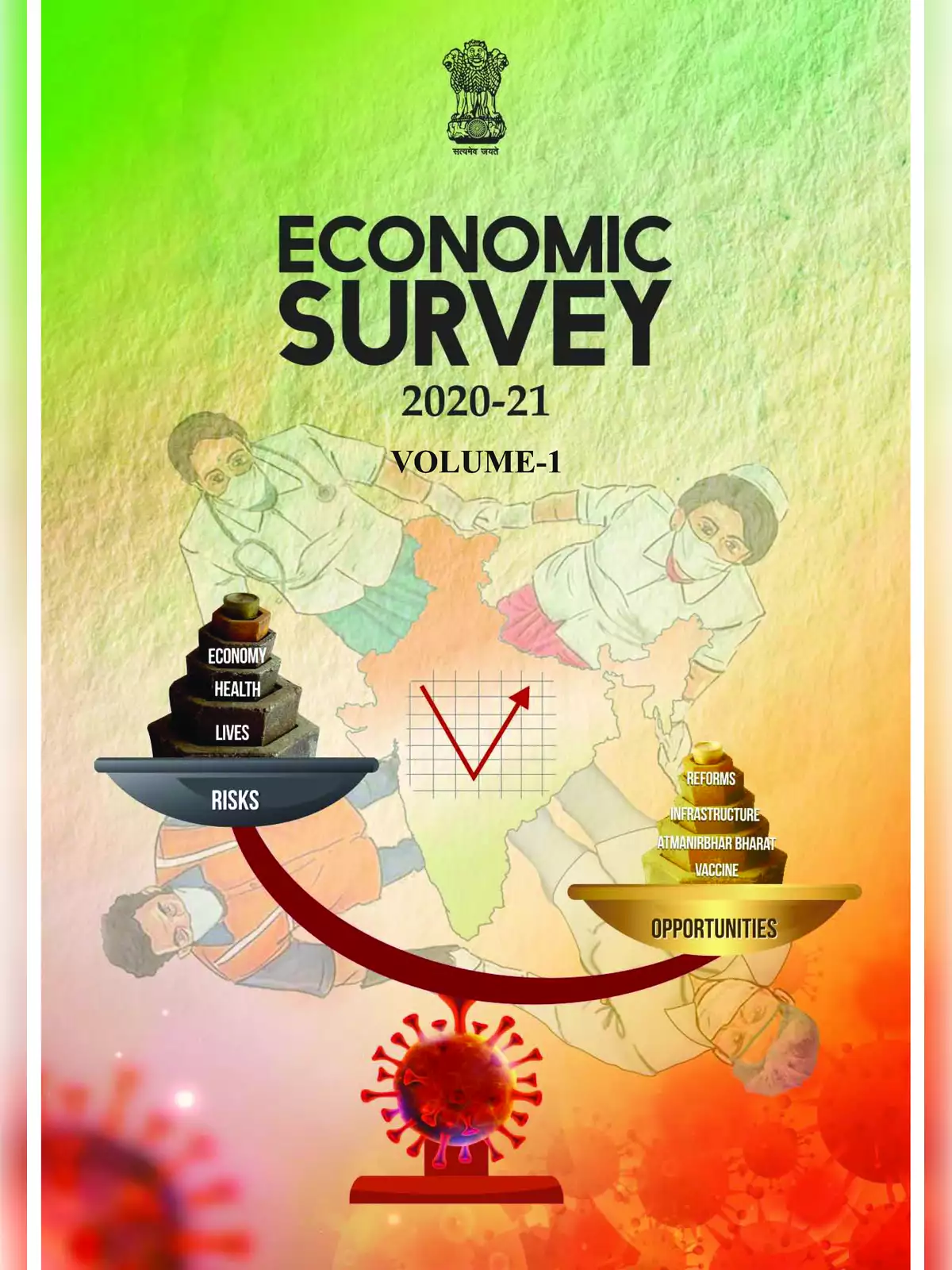

Saving Lives and Livelihoods amidst a Once-in-a-Century Crisis

• India focused on saving lives and livelihoods by its willingness to take short-term pain for long-term gain, at the onset of the COVID-19 pandemic

• Response stemmed from the humane principle that:

- Human lives lost cannot be brought back

o GDP growth will recover from the temporary shock caused by the pandemic

• An early, intense lockdown provided a win-win strategy to save lives, and preserve livelihoods via economic recovery in the medium to long-term

• Strategy also motivated by the Nobel-Prize winning research by Hansen & Sargent (2001): a policy focused on minimizing losses in a worst-case scenario when uncertainty is very high

• India’s strategy flattened the curve, pushed the peak to September, 2020

• After the September peak, India has been unique in experiencing declining daily cases despite increasing mobility

• V-shaped recovery, as seen in 7.5% decline in GDP in Q2 and recovery across all key economic indicators vis-à-vis the 23.9% GDP contraction in Q1

• COVID pandemic affected both demand and supply:

- India was the only country to announce structural reforms to expand supply in the medium-long term and avoid long-term damage to productive capacities

- Calibrated demand side policies to ensure that the accelerator is slowly pushed down only when the brakes on economic activities are being removed

- A public investment programme centered around the National Infrastructure Pipeline to accelerate the demand push and further the recovery

• Upturn in the economy, avoiding a second wave of infections – a sui generis case in strategic policymaking amidst a once-in-a-century pandemic

State of the Economy in 2020-21: A Macro View

• COVID-19 pandemic ensued global economic downturn, the most severe one since the Global Financial Crisis

• The lockdowns and social distancing norms brought the already slowing global economy to a standstill

• Global economic output estimated to fall by 3.5% in 2020 (IMF January 2021 estimates)

• Governments and central banks across the globe deployed various policy tools to support their economies such as lowering policy rates, quantitative easing measures, etc.

• India adopted a four-pillar strategy of containment, fiscal, financial, and long-term structural reforms:

o Calibrated fiscal and monetary support was provided, cushioning the vulnerable during the lockdown and boosting consumption and investment while unlocking

o A favourable monetary policy ensured abundant liquidity and immediate relief to debtors while unclogging monetary policy transmission

• As per the advance estimates by NSO, India’s GDP is estimated to grow by (-) 7.7% in FY21 – a robust sequential growth of 23.9% in H2: FY21 over H1: FY21

• India’s real GDP to record a 11.0% growth in FY2021-22 and nominal GDP to grow by 15.4% – the highest since independence:

- Rebound to be led by low base and continued normalization in economic activities as the rollout of COVID-19 vaccines gathers traction

• Government consumption and net exports cushioned the growth from diving further down, whereas investment and private consumption pulled it down

• The recovery in second half of FY2020-21 is expected to be powered by government consumption, estimated to grow at 17% YoY

• Exports expected to decline by 5.8% and imports by 11.3% in the second half of FY21

• India expected to have a Current Account Surplus of 2% of GDP in FY21, a historic high after 17 years

• On supply side, Gross Value Added (GVA) growth pegged at -7.2% in FY21 as against 3.9% in FY20:

o Agriculture set to cushion the shock of the COVID-19 pandemic on the Indian economy in FY21 with a growth of 3.4%

o Industry and services estimated to contract by 9.6% and 8.8% respectively during FY21

• Agriculture remained the silver lining while contact-based services, manufacturing, construction were hit hardest, and recovering steadily

• India remained a preferred investment destination in FY 2020-21 with FDI pouring in amidst global asset shifts towards equities and prospects of quicker recovery in emerging economies:

o Net FPI inflows recorded an all-time monthly high of US$ 9.8 billion in November 2020, as investors’ risk appetite returned

o India was the only country among emerging markets to receive equity FII inflows in 2020

• Buoyant SENSEX and NIFTY resulted in India’s market-cap to GDP ratio crossing 100% for the first time since October 2010

• Softening of CPI inflation recently reflects easing of supply side constraints that affected food inflation

• Mild contraction of 0.8% in investment (as measured by Gross Fixed Capital Formation) in 2nd half of FY21, as against 29% drop in 1st half of FY21

• Reignited inter and intra state movement and record-high monthly GST collections have marked the unlocking of industrial and commercial activity

• The external sector provided an effective cushion to growth with India recording a Current Account Surplus of 3.1% of GDP in the first half of FY21:

o Strong services exports and weak demand leading to a sharper contraction in imports (merchandise imports contracted by 39.7%) than exports (merchandise exports contracted by 21.2%)

o Forex reserves increased to a level so as to cover 18 months worth of imports in December 2020

o External debt as a ratio to GDP increased to 21.6% at end-September 2020 from 20.6% at end-March 2020

o Ratio of forex reserves to total and short-term debt improved because of the sizable accretion in reserves

• V-shaped recovery is underway, as demonstrated by a sustained resurgence in high frequency indicators such as power demand, e-way bills, GST collection, steel consumption, etc.

• India became the fastest country to roll-out 10 lakh vaccines in 6 days and also emerged as a leading supplier of the vaccine to neighbouring countries and Brazil

• Economy’s homecoming to normalcy brought closer by the initiation of a mega vaccination drive:

o Hopes of a robust recovery in services sector, consumption, and investment have been rekindled

o Reforms must go on to enable India realize its potential growth and erase the adverse impact of the pandemic

• India’s mature policy response to the ‘once-in-a-century’ crisis provides important lessons for democracies to avoid myopic policy-making and demonstrates benefits of focusing on long-term gains

Process Reforms

• India over-regulates the economy resulting in regulations being ineffective even with relatively good compliance with process

• The root cause of the problem of overregulation is an approach that attempts to account for every possible outcome

• Increase in complexity of regulations, intended to reduce discretion, results in even more non-transparent discretion

• The solution is to simplify regulations and invest in greater supervision which, by definition, implies greater discretion

• Discretion, however, needs to be balanced with transparency, systems of ex-ante accountability and ex-post resolution mechanisms

• The above intellectual framework has already informed reforms ranging from labour codes to removal of onerous regulations on the BPO sector

Regulatory Forbearance an emergency medicine, not staple diet!

• During the Global Financial Crisis, regulatory forbearance helped borrowers tide over temporary hardship

• Forbearance continued long after the economic recovery, resulting in unintended consequences for the economy

• Banks exploited the forbearance window for window-dressing their books and misallocated credit, thereby damaging the quality of investment in the economy

• Forbearance represents emergency medicine that should be discontinued at the first opportunity when the economy exhibits recovery, not a staple diet that gets continued for years

• To promote judgement amidst uncertainty, ex-post inquests must recognize the role of hindsight bias and not equate unfavourable outcomes to bad judgement or malafide intent

• An Asset Quality Review exercise must be conducted immediately after the forbearance is withdrawn

• The legal infrastructure for the recovery of loans needs to be strengthened de facto

Innovation: Trending Up but Needs Thrust, Especially from the Private Sector

• India entered the top-50 innovating countries for the first time in 2020 since the inception of the Global Innovation Index in 2007, ranking first in Central and South Asia, and third amongst lower middle-income group economies

• India’s gross domestic expenditure on R&D (GERD) is lowest amongst top ten economies

• India’s aspiration must be to compete on innovation with the top ten economies

• The government sector contributes a disproportionately large share in total GERD at three times the average of top ten economies

• The business sector’s contribution to GERD, total R&D personnel and researchers is amongst the lowest when compared to top ten economies

• This situation has prevailed despite higher tax incentives for innovation and access to equity capital

• India’s business sector needs to significantly ramp up investments in R&D

• Indian resident’s share in total patents filed in the country must rise from the current 36% which is much below the average of 62% in top ten economies

• For achieving higher improvement in innovation output, India must focus on improving its performance on institutions and business sophistication innovation inputs

JAY Ho! PM‘JAY’ Adoption and Health outcomes

• Pradhan Mantri Jan Arogya Yojana (PM-JAY) – the ambitious program launched by Government of India in 2018 to provide healthcare access to the most vulnerable sections demonstrates strong positive effects on healthcare outcomes in a short time

• PM-JAY is being used significantly for high frequency, low cost care such as dialysis and continued during the Covid pandemic and the lockdown.

• Causal impact of PM-JAY on health outcomes by undertaking a Difference-in-Difference analysis based on National Family Health Survey (NFHS)-4 (2015-16) and NFHS-5 (2019-20) is following:

- Enhanced health insurance coverage: The proportion of households that had health insurance increased in Bihar, Assam and Sikkim from 2015-16 to 2019-20 by 89% while it decreased by 12% over the same period in West Bengal

- Decline in Infant Mortality rate: from 2015-16 to 2019-20, infant mortality rates declined by 20% for West Bengal and by 28% for the three neighbouring states

- Decline in under-5 mortality rate: Bengal saw a fall of 20% while, the neighbours witnessed a 27% reduction

- Modern methods of contraception, female sterilization and pill usage went up by 36%, 22% and 28% respectively in the three neighbouring states while the respective changes for West Bengal were negligible

- While West Bengal did not witness any significant decline in unmet need for spacing between consecutive kids, the neighbouring three states recorded a 37% fall

- Various metrics for mother and child care improved more in the three neighbouring states than in West Bengal.

• Each of these health effects manifested similarly when we compare all states that implemented PM-JAY versus the states that did not

• Overall, the comparison reflects significant improvements in several health outcomes in states that implemented PM-JAY versus those that did not

Also Check – Economic Survey 2020-21 Volume 2

You can download the Economic Survey 2020-21 in PDF format using the link given below or an alternative link for more details.