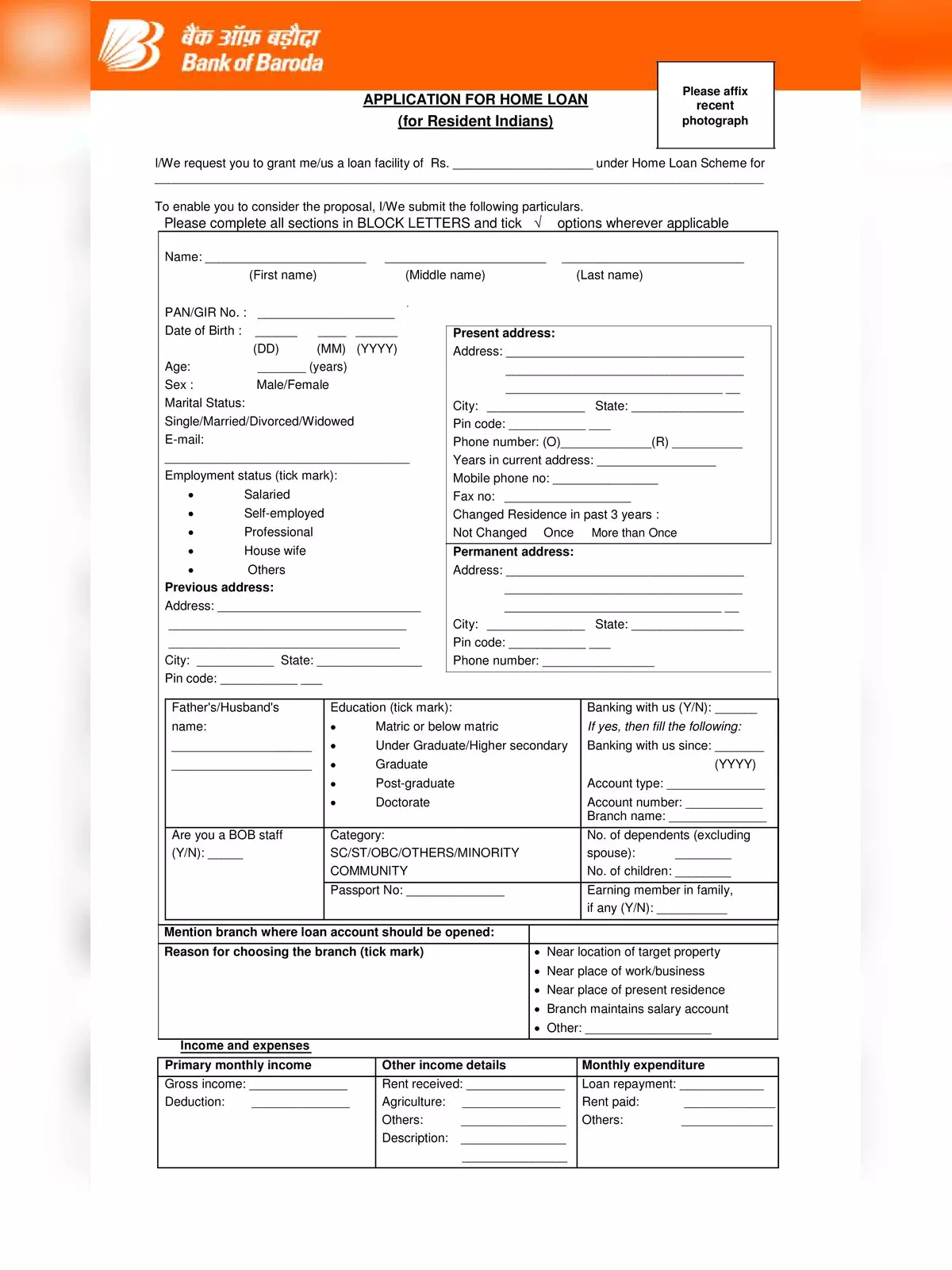

Bank of Baroda Home Loan Application Form

This is an application form for Home Loan issued by the Bank of Baroda and this form be downloaded from the bank’s official website i.e. https://www.bankofbaroda.in/, or it can be directly downloaded from the link given below.

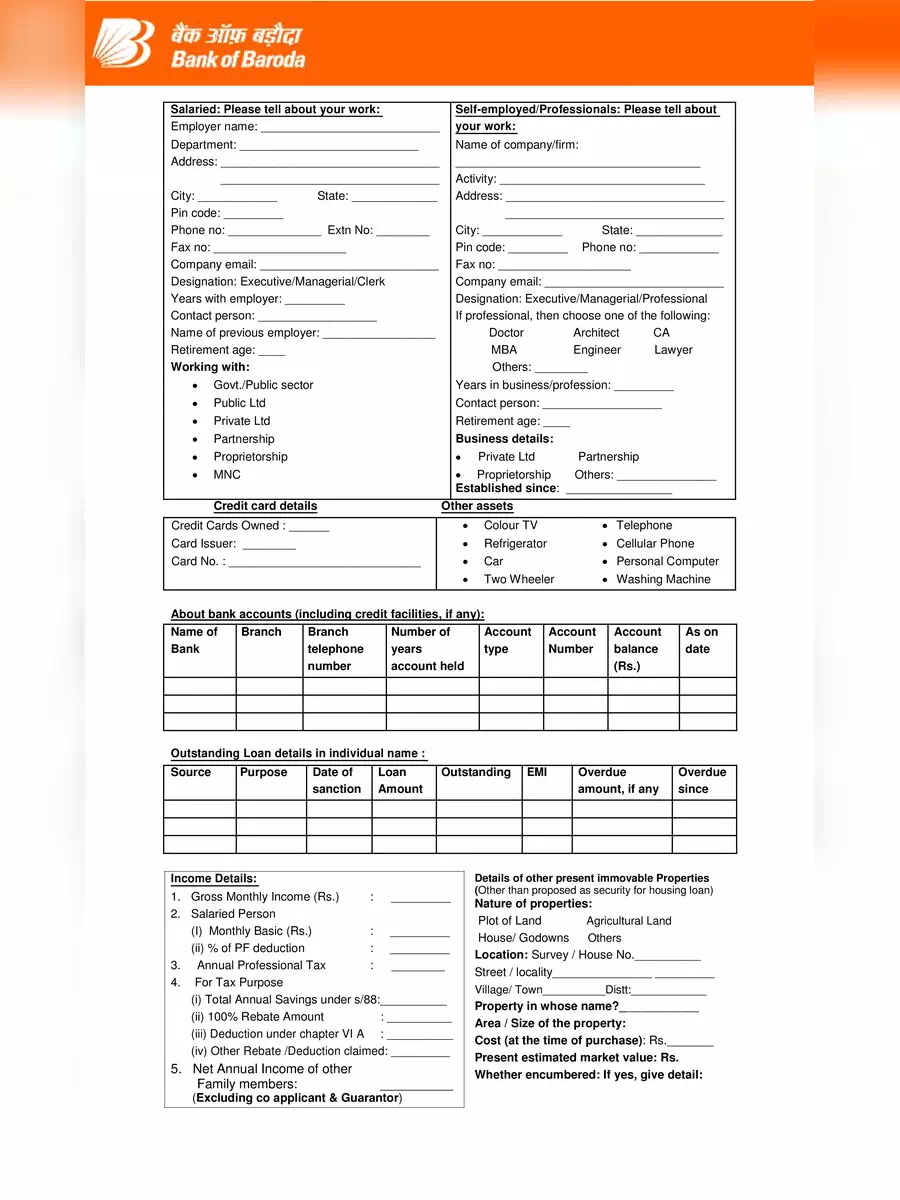

Details to be Mentioned in Bank of Baroda Home Loan Application Form

- Name of the Applicants

- PAN/GIR No

- Present address

- Employment status

- Income and expenses

- About bank accounts details

- Outstanding Loan details in the individual name

- Income Details

- Information on Guarantor/Co-applicant

- Net worth

- Proposed Loan Details

- Details of Movable Assets in my name

- And any other details

Eligible for Home Loan

All resident and non-resident Indians between 21 and 70 years are eligible for our home loans.

- Purchase of new/old dwelling unit.

- Construction of house.

- Purchase of a plot of land for the construction of a house.

- Repaying a loan already taken from another Housing Finance Company / Bank.

- Repayment period up to 30 years (floating rate option).

- Reimbursement of cost of a plot of land (purchased within 24 months)

Loan amount: The approved home loan amount varies according to the location and income of the applicants. For instance, in semi-urban and rural areas the maximum amount is Rs. 1 crore, while in metros the maximum home loan amount can range from Rs. 5 crores to Rs. 10 crore.

Interest rate: The interest rate is linked to the Baroda Repo Linked Lending Rate(BRLLR) of the bank and is reset monthly.

MCLR rate w.e.f from 12.04.2021

| Sr. No. | MCLR Benchmark | MCLR in (%) w.e.f. 12.04.2021 |

|---|---|---|

| 1 | Overnight MCLR | 6.55 |

| 2 | 1 Month MCLR | 7.00 |

| 3 | 3 Month MCLR | 7.15 |

| 4 | 6 Month MCLR | 7.25 |

| 5 | 1 Year MCLR | 7.40 |

| Base Rate (per annum) w.e.f. 01.07.2020 | 8.15% |

Our BPLR for all the existing accounts is 12.45% per annum w.e.f from 01.07.2020

Tenure and moratorium: The tenure on our home loans varies based on the loan amount and the income of the borrower, and the maximum tenure is 30 years. There is also a moratorium period on home loans, which can be a maximum of up to 36 months after the loan amount is disbursed.

Collateral: We require collateral against home loans. Generally, we accept mortgages of the constructed or purchased property as collateral. In some cases, collateral for home loans can be accepted in the form of insurance policies, government promissory notes, shares and debentures, gold ornaments, etc.

Documents Required

- Duly Filled and Signed Application form along with three Photographs

- Proof of Identity – PAN CARD (mandatory for loan application above Rs.10.00lacs

- Driver’s License / Voter ID / Passport / Aadhar Card

- Proof of Residence(Driver’s License / Ration Card/ Voter ID / Passport / Aadhar Card / Registered Rent Agreement)

- If any previous loan then loan a/c statement for last 1 year along with sanction letter. ( If loan from BoB, Account No / Cust Id required)

- Proof of assets held like LIC/NSC/KVP/MF/PROPERTY

- Assets and Liabilities statement

- ITR Verification report

For more documents details – Documents List

Repayment Period

- The maximum period of loans shall be -30- years initially, including the maximum moratorium period of -36-months.

- The maximum moratorium period shall be -36- months as under

- 18- month moratorium period for construction Houses and Building up to 7th Floor and thereafter -6- months additional moratorium per floor subject to a maximum moratorium of -36- months.

Age

Minimum: Borrower – 21 years, Co-applicant- 18 years

Maximum: Maximum age can be considered up to 70 Years*

Security

- Mortgage of the Property constructed/ purchased or

- If the mortgage is not feasible, Bank at its discretion can accept security in the form of Insurance Policies, Govt Promissory Notes, Shares and Debentures, Gold Ornaments, etc.

Download the Bank of Baroda Home Loan Application Form in PDF format using the link given below or an alternative link for more details.