Adani Reply to Hindenburg

Adani Group gives details responses to Hindenburg Report with strongly worded statements slamming the Hindenburg report as malicious have failed to stop its slide on the stock market. The document is a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive. This is rife with conflict of interest and intended only to create a false market in securities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors.

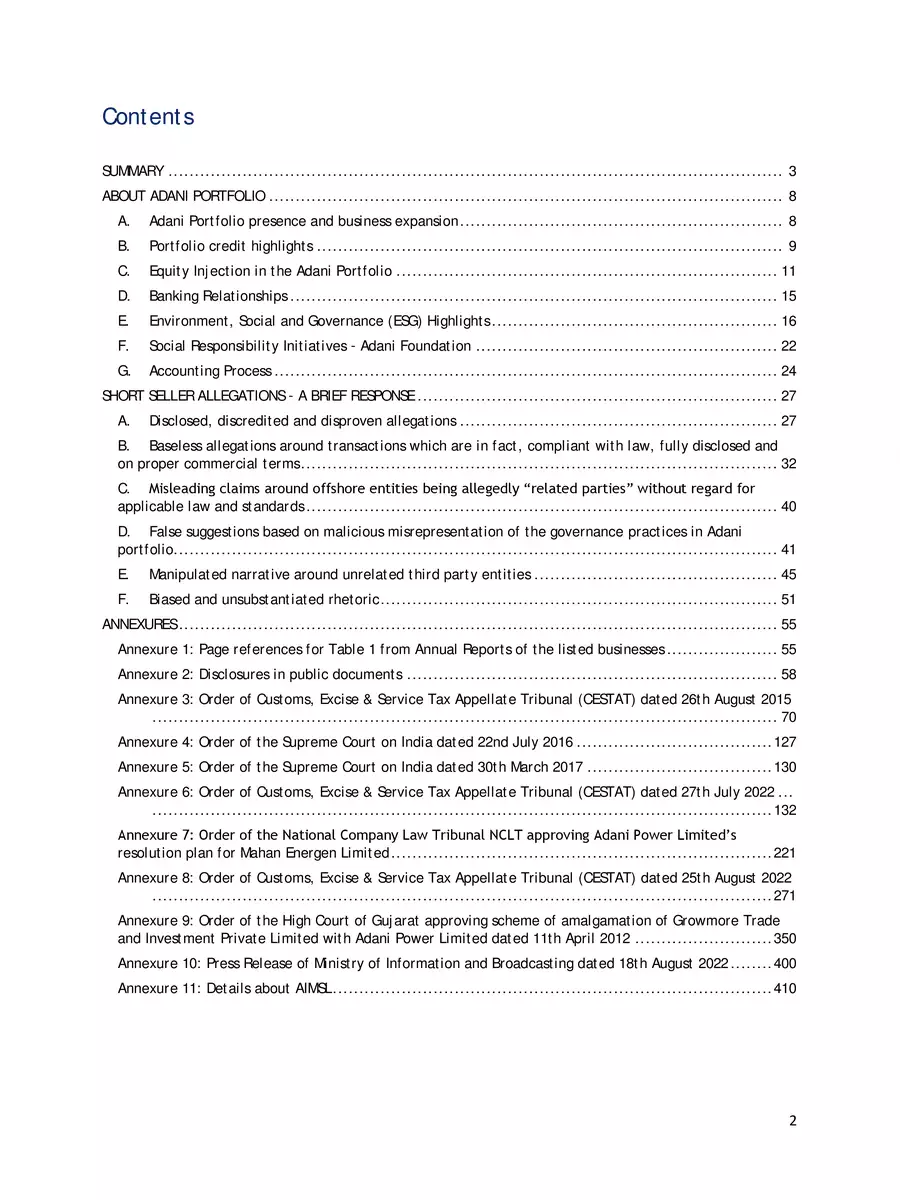

Adani Group also said that this is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India. The report seeks answers to “88 questions” – 65 of these relate to matters that have been duly disclosed by Adani Portfolio companies in their annual reports available on their websites, offering memorandums, financial statements and stock exchange disclosures from time to time

Aadani Response to Hindenburg – Adani Reply to Hindenburg

- Adani Group has dismissed 21 of the questions, since they are based on disclosures in public documents from 2015 onwards, and can’t be considered as the result of an investigation in the past two years. It also mentioned that these 21 queries are in relation to court cases, directorate of revenue intelligence and related party transactions, and didn’t respond to them.

- Baseless allegations around transactions which are in fact, compliant with law, fully disclosed and on proper commercial terms: Allegation no. 9, 15, 19, 24, 25, 32, 33, 35, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50, 51, 53, 54, 55, 56, 57, 58, 59, 60, 61, 81, 82 & 83 are again a selective regurgitation of disclosures from the financial statements of Adani entities to paint a biased picture. These disclosures have already been approved by third parties who are qualified and competent to review these (rather than an unknown overseas shortseller) and are in line with applicable accounting standards and applicable law.

- Misleading claims around offshore entities being allegedly “related parties” without regard for applicable law and standards: Allegation no. 4, 36, 37, 38, and 39 from the report are in reference to offshore entities. The queries make reckless statements without any evidence whatsoever and purely on unsubstantiated speculations without any understanding of the Indian laws around related parties and related party transactions.

- False suggestions based on malicious misrepresentation of the governance practices in Adani portfolio: Allegations no. 34, 62, 63, 64, 65, 66, 67, 68, 69, 70, and 71 use selective information to make insinuations, when in fact, the Adani portfolio has instituted various corporate governance policies and committees including our Corporate Responsibility Committee consisting solely of independent directors tasked with keeping the Board of Directors informed about the ESG performance of businesses. Our ESG approach is based on well-thought-out goals, commitments and targets which are independently verified through an assurance process.

- Manipulated narrative around unrelated third-party entities: Allegations no. 5, 6, 7, 8, 10, 11, 12, 13, 14, 16, 17, 18, 20, 21, 22, 23, 26 and 52 from the report seek information on our public shareholders. Shares of listed companies on Indian stock exchanges are traded on a regular basis. The listed entity does not have control over who buys/sells/owns the publicly traded shares in the company. A listed company does not have nor is it required to have information on its public shareholders and investors.

- Biased and unsubstantiated rhetoric: Allegations no. 84, 85, 86, 87, and 88 from the report are inherently biased statements around our openness to address criticism with a window dressing to garb them as questions. Criticism does not include the right to make a false and defamatory statement that could damage the interests of our stakeholders. We continue to have the right to seek judicial remedy before Indian courts when such interests are threatened, and in all cases, we have exercised these rights in due compliance with law and the judicial process.

You can download the Aadani Response to Hindenburg PDF using the link given below.