Vivad Se Vishwas Scheme 2023 Form PDF download link and step by step procedure

Vivad Se Viaswas Scheme 2023

The ‘Vivad se Vishwas’ Scheme was announced to provide for dispute resolution in respect of pending income tax litigation. The objective of Vivad se Vishwas scheme is to inter alia reduce pending income tax litigation, generate timely revenue for the Government and benefit taxpayers by providing them peace of mind, certainty and savings on account of time and resources that would otherwise be spent on the long-drawn and vexatious litigation process.

Download Vivad Se Viswas Scheme 2023 PDF from Income Tax India website using this link: https://www.incometaxindiaefiling.gov.in/eFiling/Portal/StaticPDF/Vivad_Se_Vishwas_PDF_Links/Brief_DTVSV_Scheme.pdf

Vivad se Vishwas Scheme 2023 Form and Procedure

Complete detail procedure for making declaration in Form 1 and 2 under sub-rule (2) of Rule 3 under The Vivad se Viaswas Scheme 2023 in PDF format online from the official website link.

Form-1 Form for filing declaration.

Form-2 Undertaking Under Sub-Section (5) Of Section 4 Of The Direct Tax Vivad Se Vishwas Act, 2020 (3 Of 2023).

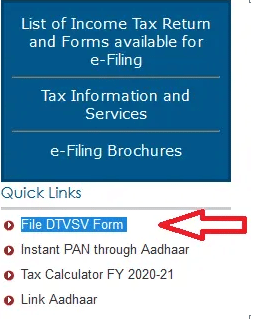

Step 1 :- First of all, applicants are required to visit the department website www.incometaxindiaefiling.gov.in to make the declaration in Form-1 online.

Step 2:- Click on the “File DTVSV Form ” it will be shown on the official website of Income tax Department as shown below.

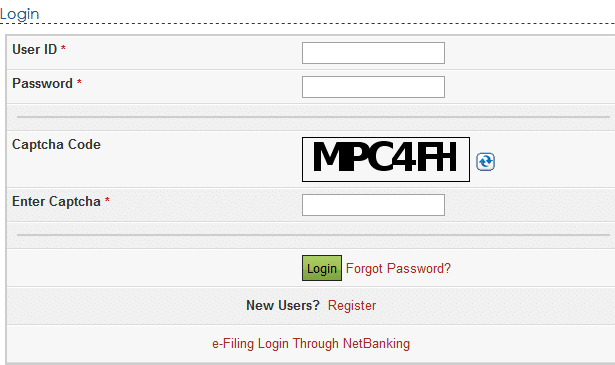

Step 3:- After click on “File DTVSV Form,” you have to enter the ID , Password, and Captcha Code of the Income-tax department site as shown below.

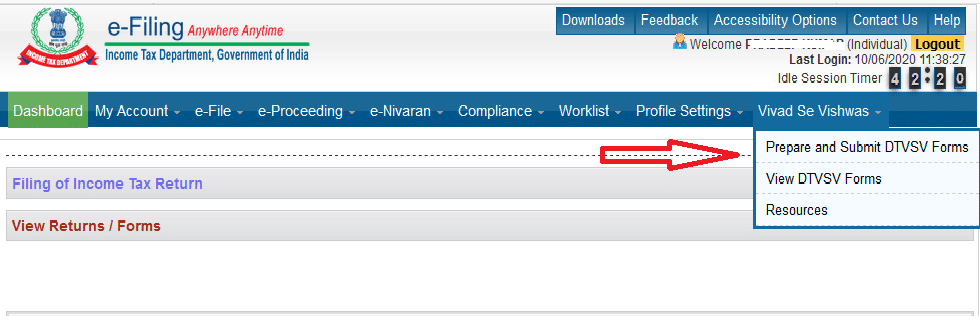

Step 4:- After login the income-tax department website you have to click on “Vivad se Viaswas” as shown below.

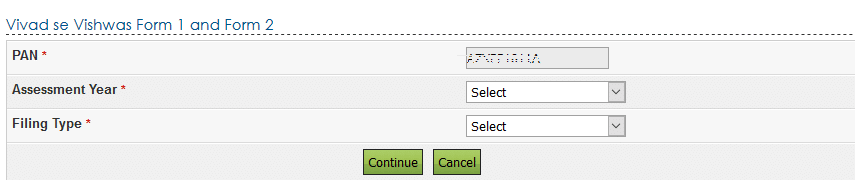

Step 5 :-Now you have to click on “Prepare and Submit DTVSV Form” for filing Vivad se Vishwas Form 1 & 2 by select the Assessment Year and Filing type as shown below.

Step 6:- After enter the AY and Filing type you can fill the declaration form for Vivad se Vishwas scheme. In this form. Part A form in following manner :-

| Acknowledgement Number of Original Form 1 | This field will auto populate as acknowledgment number of Original Form 1 filed for that AY/FY in PAN/TAN login respectively. |

| PAN / TAN | PAN/ TAN will be auto populated from Login profile and is non editable.For PAN users, Schedule A or/and Schedule C are applicable.

For TAN users, Schedule B or/and Schedule C are applicable. |

| Aadhaar No. | This field is applicable only for individuals and in PAN login. If “Aadhaar” is updated in profile and linked with PAN, then the same will be auto populated. Else, Assessee may enter the Aadhaar.For TAN users, this field is not applicable. |

| First Name of appellant | This shall be auto populated and non- editable. |

| Middle Name of appellant | This shall be auto populated and non- editable. |

| Last Name of appellant | This shall be auto populated and non- editable. |

| Mobile No. | Mobile number will be prefilled as per profile and non editable. In case appellant wants to update, please update the same in “My profile” |

| Email Address | Email will be prefilled as per profile and non editable. In case appellant wants toupdate, please update the same in “My profile” |

| Whether the applicant is appellant in terms of section 2 of the DTVSV and is not ineligible to apply in terms of section 9 of DTVSV? | Please select the option from below dropdowns:Yes No

If selects “No”, appellant is not allowed to file Form as he is not eligible under this scheme. |

| Option exercised by AppellantWhether opting to pay tax on reduction of losses or depreciation or MAT credit If Yes go to relevant schedule under A; If No fill up schedule D | Please select the option from below dropdowns: Yes / No

If appellant selects “No”, appellant has to fill schedule D along with applicable. This question is not applicable in case of TAN login. |

| PART B – INFORMATION RELATING TO DISPUTE | |

| Nature of tax arrear | Please select nature of tax arrear from below dropdowns:Disputed Tax Disputed Interest Disputed Penalty Disputed Fee Note :

If a single order consists of “Disputed Tax, Interest on such Disputed Tax, penalty on such disputed tax, then appellant has to choose “Disputed tax”. If an order, consists of only “Disputed Penalty”, then appellant has to choose “Disputed Penalty”. If an order, consists of only “Disputed Interest”, then appellant has to choose “Disputed Interest”. If an order, consists of only “Disputed fee”, then appellant has to choose “Disputed fee”. |

| Assessment Year/Financial Year | This field shall be auto populated from the “Assessment Year” / “Financial Year” selected before proceeding to form. |

| Section under which order passed (there could be multiple sections for sameassessment year) | Please select the section under which order passed from the provided dropdowns. |

| Read with section | Please select the ‘read with section’ under which order passed from the provided dropdowns. |

| Income-tax authority / Appellate Forum who passed the order (there could be multiple orders for same assessment year) | Please select the option from below dropdowns :Assessing Officer

Addl CIT/Addl DIT/JCIT/JDIT PCIT/PDIT/CIT/DIT CIT(A) DRP AAR ITAT |

| High Court | |

| Date on which order passed (there could be multiple dates for same assessment year) | Please enter date of order passed against which appeal is being filed. Date cannot be after 31/01/2020 |

| Whether Search case? | Please select the option from below dropdowns:Yes No |

| Whether search case with disputed tax less than or equal to Rs. 5 crores in the assessment year? (information flag relevant for rate at which amount payable is to be computed) | Please select the option from below dropdowns:Yes No

In case, “Disputed Tax” is related to “Search case” with disputed tax =< Rs. 5 Crores , please select “Yes” In case “Disputed Tax” is related to “Search case” with disputed tax > Rs. 5 Crores, Please select “No” If selects “No”, appellant is not allowed to file Form 1 as he is not eligible under this scheme. |

| Details of pending | Header |

| Whether Appeal/objection/revision/Writ / SLP/Arbitration/Conciliation/Mediation? | Please select the option from below dropdowns: Arbitration/Conciliation/ Mediation Appeal Objection Revision Writ SLP |

| Appellate Forum | If “Appeal” is selected above, then select one of below options :CIT(A) ITAT

High Court Supreme Court If “Objection” is selected above, then “DRP” will be auto-populated and non- editable. If “Revision” is selected above, then “CIT/PCIT” will be auto-populated and non-editable. If “Writ” is selected above, then select one of below options : High Court Supreme Court |

| If “SLP” is selected above, then “Supreme Court” will be auto-populated and non-editable.If “Arbitration/Conciliation/ Mediation” is selected above then Appellate Forum is not applicable. | |

| Whether already filed? | Please select the option from below dropdowns:Yes No |

| If No, date on which time-limit for filingexpires in case of Assessee | Please enter date on which time-limit for filing appeal expires in case of Assessee. |

| If yes, filed by | Please select from below dropdowns : Assessee Department Both |

| Date of filing – Filed by Assessee | Please enter the date of filing of appeal filed by Assessee. However if appeal filed by “both” then enter the date of filing of appeal filed by the Assessee. |

| Date of filing -Filed by Department | Please enter the date of filing of appeal filed by department. However if appeal filed by “both” then enter the date of filing of appeal filed by the department. |

| Reference number -Filed by Assessee | Please enter the reference number of appeal filed by Assessee. However if appeal filed by “both” then enter the reference number of appeal filed by the Assessee. |

| Reference number -Filed by Department | Please enter the reference number of appeal filed by department. However if appeal filed by “both” then enter the reference number of appeal filed by the department. |

| Whether DRP case? | This field shall be auto populated based on dropdown selected at field “Income- tax authority / Appellate Forum who passed the order” |

| If yes, whether directions passed by DRP on or before 31.1.2020? | Please select the option from below dropdowns:Yes No |

| If yes, whether order passed by AO? (If yes, not eligible) | Please select the option from below dropdowns:Yes No

If “Yes” is selected, appellant will not be allowed to proceed further as it is not covered under the scheme |

| Whether revision application case? | Please select the option from below dropdowns: |

| Yes No | |

| If yes, date of filing | If above field is selected as “Yes” then please enter the date of filing of revision application. |

| If declaration is with respect to appeal, writ, SLP, arbitration, conciliation or mediation for disputed tax including disputed TDS/TCS appeal , is there pending appeal, writ or SLP for interest or penalty imposed in relation to suchdisputed tax | Please select the option from below dropdowns:Yes No

If “Yes” is selected then appellant is to provide the connected penalty and interest details in below field. |

| For Penalty | Header |

| Appeal reference number | Please enter the “Appeal Reference Number”. |

| Appellate authority where appeal is pending | Please select the option from below dropdowns :PCIT/CIT CIT(A) DRP ITAT

High Court Supreme Court |

| Amount of Penalty | Please enter the disputed Penalty connected to disputed tax. |

| For Interest | Header |

| Appeal reference number | Please enter the “Appeal Reference Number”. |

| Appellate authority where appeal is pending | Please select the option from below dropdowns :PCIT/CIT CIT(A) DRP ITAT

High Court Supreme Court |

| Amount of Interest | Please enter the disputed interest connected to disputed tax. |

| PART C – INFORMATION RELATED TO TAX ARREAR | |

| Tax arrears (as per schedule) | This field is auto populated as sum of tax arrear from all the schedules. |

| PART D – INFORMATION RELATED TO AMOUNT PAYABLE | |

| Total amount payable under DTVSV if paid on or before 31.3.2020 | This field is auto populated as sum of ‘X’ from all the schedules and non-editable. |

| Total amount payable under DTVSV if paid after 31.03.2020 | This field is auto populated as sum of ‘Y’ from all the schedules and non-editable. |

| PART E – INFORMATION RELATED TO PAYMENTS AGAINST TAX ARREAR | |

| Whether the declarant has made any payment against tax arrears before filing of declaration? | Please select the option from below dropdowns:Yes No |

| BSR Code | If “Yes” is selected in above field, Please enter the seven digit BSR code of Bank at which tax was deposited. |

| Date of Payment | Please enter date of payment in DD/MM/YYYY format. |

| Serial Number of Challan | Please enter serial number of challan. |

| Amount | Please enter amount paid. |

| Add Row | Please add rows to enter details of more than one challan. |

| Total payments against tax arrears | This field is auto populated from total of amount paid in above table. |

| Refund Adjusted against tax arrears | Please enter the amount which was adjusted against the tax arrears. |

| Part F -Net amount payable/refundable by the appellant: Part D (i) or D (ii), as the case may be, less [Part E (iii)+E(iv)] | This field is auto populated as D(i) or D(ii), as the case may be, less [Part E(iii)+E(iv)] and non-editable. |

INSTRUCTIONS FOR FILLING SCHEDULE A

| S. No. in Form | Field Name | Instruction |

| A. Schedules applicable where declaration relates to disputed tax (Applicable in case of PAN) | Incase of appeals related ‘Disputed Tax’, this schedule need to be filled. This will be applicable for PAN users. Please ensure to fill the details regarding each appeal in different tables by using add row. | |

| Schedule I. To be filled in case appeal of Assessee is pending before CIT(A) as on 31.01.2020 or the time for filing appeal by the Assessee before CIT(A) has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “CIT(A)” filed by “Assessee” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “CIT(A)” filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per draft order against which objections filed or to be filed | Please enter the total income as per issued order against which appeal filed or to be filed |

| B(i) | Disputed income# out of A – relating to issues, which have been decided in favor of Assessee in his case for any assessment year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not bee subsequently reversed by the Supreme Court) | Please enter the disputed income which have been decided in favor of Assessee in his case for any financial year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) |

| B(ii) | Disputed income# out of A – relating to issues other than B(i) | Please enter the disputed tax amount related to other than amount mentioned in B(i). |

| C | Disputed tax* in relation to disputed income at B(i) | Please enter the disputed tax on disputed income at B(i). |

| D | Disputed tax in relation to disputed income at B(ii) | Please enter the disputed tax on disputed income at B(ii). |

| E | Tax effect of enhancement**, if any, by CIT(A) | Please enter the tax effect of enhancement made by the CIT(A) |

| F | Total disputed tax (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| G | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| H | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| I | Tax arrears (F+G+H) | This field shall be auto populated as F+G+H and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C + D + E | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C + D + E | |

| If search case 0.625*C+1.25*D + 1.25*E | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C +1.25* D +1.25*E | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C + 1.1*D + 1.1*E | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D + 1.1*E | |

| If non search case 0.675*C + 1.35*D + 1.35*E | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*C +1.35*D + 1.35*E | |

| Schedule II- To be filled in case Assessee has filed objections with DRP against draft assessment order and DRP has not issued any directions as on 31.01.2020 or the time-limit to file objections against draft order passed by AO has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “DRP” against draft assessment order filed by “Assessee” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “DRP” filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per draft order against which objections filed or to be filed | Please enter the total income as per draft order against which objection filed or to be filed |

| B(i) | Disputed income out of A – relating to issues, which have been decided in favor of Assessee in his case for any assessment year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) | Please enter the disputed income which have been decided in favor of Assessee in his case for any financial year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) |

| B(ii) | Disputed income out of A – relating to issues other than B(i) | Please enter the disputed tax amount related to other than amount mentioned in B(i). |

| C | Disputed tax in relation to disputed income at B(i) | Please enter the disputed tax on disputed income at B(i). |

| D | Disputed tax in relation to disputed income at B(ii) | Please enter the disputed tax on disputed income at B(ii). |

| E | Total disputed tax (C+D) | This field shall be auto populated as C+D and non- editable. |

| F | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| G | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| H | Tax arrears (E+F+G) | This field shall be auto populated as E+F+G and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C + D | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C + D | |

| If search case 0.625*C +1.25*D | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C +1.25* D | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C + 1.1*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D | |

| If search case 0.675*C +1.35*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D | |

| Schedule III. To be filled in case DRP has issued directions u/s 144C of the Act in response to objections filed by the Assessee and Assessing Officer has not passed the order as per such directions issued by DRP as on 31.01.2020 | Please fill the below details in case the appeal is related to direction issued by DRP and Assessing Officer has not passed the order related to the disputed tax. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to direction issued by DRP and Assessing Officer has not passed the order related to the disputed tax. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per directions of DRP | Please enter the total income as per direction issued by DRP against which objection filed or to be filed |

| B(i) | Disputed income out of A – relating to issues, which have been decided in favor of Assessee in his case for any assessment year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) | Please enter the disputed income which have been decided in favor of Assessee in his case for any financial year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) |

| B(ii) | Disputed income out of A –relating to issues other than B(i) | Please enter the disputed tax amount related to other than amount mentioned in B(i). |

| C | Disputed tax in relation to disputed income at B(i) | Please enter the disputed tax on disputed income at B(i). |

| D | Disputed tax in relation to disputed income at B(ii) | Please enter the disputed tax on disputed income at B(ii). |

| E | Total disputed tax (C+D) | This field shall be auto populated as C+D and non- editable. |

| F | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| G | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| H | Tax arrears (E+F+G) | This field shall be auto populated as E+F+G and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C + D | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C + D | |

| If search case 0.625*C +1.25*D | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C +1.25* D | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C + 1.1*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D | |

| If search case 0.675*C +1.35*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D | |

| Schedule IV. To be filled in case appeal of Assessee is pending before ITAT as on 31.01.2020 or the time for filing appeal by the Assessee before ITAT has not expired as on 31.01.2020 | Please fill the below details in case the appeal is related to “Disputed tax” and pending with “ITAT” filed by “Assessee/Both” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “ITAT” filed by “Assessee/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which appeal filed or to be filed | Please enter the total income as per order against which appeal filed or to be filed |

| B(i) | Disputed income out of A – relating to issues, which have been decided in favor of Assessee in his case for any assessment year by High Court (and such order has not been subsequently reversed by the Supreme Court) | Please enter the disputed income which have been decided in favor of Assessee in his case for any assessment year by High Court (and such order has not been subsequently reversed by the Supreme Court) |

| B(ii) | Disputed income out of A – relating to issues other than B(i) | Please enter the disputed tax amount related to other than amount mentioned in B(i). |

| C | Disputed tax in relation to disputed income at B(i) | Please enter the disputed tax on disputed income at B(i). |

| D | Disputed tax in relation to disputed income at B(ii) | Please enter the disputed tax on disputed income at B(ii). |

| E | Total disputed tax (C+D) | This field shall be auto populated as C+D and non- editable. |

| F | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| G | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| H | Tax arrears (E+F+G) | This field shall be auto populated as E+F+G and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C + D | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C + D | |

| If search case 0.625*C+1.25*D | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C +1.25* D | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C + 1.1*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C +1.1*D | |

| If search case 0.675*C +1.35*D | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*C +1.35*D | |

| Schedule V. To be filled in case appeal of Department is pending before ITAT as on 31.01.2020 or the time to file appeal by the department in ITAT has not expired on 31.01.2020. | Please fill the below details in case the appeal is related to “Disputed tax” and pending with “ITAT” filed by “Department/Both” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “ITAT” filed by “Department/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which appeal filed or to be filed | Please enter the total income as per order against which appeal filed or to be filed |

| B. | Disputed income out of A | Please enter the Disputed income. |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed Tax. |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C | |

| If search case 0.625*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C | |

| If search case 0.675*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*C | |

| Schedule VI. To be filled in case appeal or writ of Assessee is pending before High Court as on 31.01.2020 or the time for filing appeal or writ by the Assessee before High Court has not expired as on 31.01.2020 | Please fill the below details in case the appeal/writ is related to “Disputed tax” and pending with “High Court” filed by “Assessee/Both”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “High court” filed by “Assessee/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per orderagainst which appeal or writ filed or appeal to be filed | Please enter the total income as per order against which appeal filed or to be filed |

| B. | Disputed income out of A | Please enter the Disputed income out of A |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed Tax. |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than C | |

| If search case 1.25*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*C | |

| If search case 1.35*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*C | |

| Schedule VII. To be filled in case appeal or writ of Department is pending before High Court as on 31.01.2020 or the time to file appeal or writ by the department in HC has not expired on 31.01.2020. | Please fill the below details in case the appeal/writ is related to “Disputed tax” and pending with “High Court” filed by “Department/Both”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “High court” filed by “Department/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which appeal or writ filed or appeal to be filed | Please enter the total income as per order against which appeal filed or to be filed |

| B. | Disputed income out of A | Please enter the Disputed income. |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed Tax in relation to disputed income at B |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C | |

| If search case 0.625*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C | |

| If search case 0.675*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*C | |

| Schedule VIII. To be filled in case appeal or writ or SLP of Assessee is pending before Supreme Court as on 31.01.2020 or the time for filing appeal or writ or SLP by the Assessee before Supreme Court has not expired as on 31.01.2020 | Please fill the below details in case the appeal/writ is related to “Disputed tax” and pending with “Supreme Court” filed by “Assessee/Both”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “Supreme Court” filed by “Assessee/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which appeal or writ or SLP filed or appeal or SLP to be filed | Please enter the total income as per order against which appeal/writ/SLP filed or to be filed |

| B. | Disputed income out of A | Please enter the Disputed income out of A |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed Tax in relation to disputed income at B |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than C | |

| If search case 1.25*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*C | |

| If search case 1.35*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*C | |

| Schedule IX. To be filled in case appeal or writ or SLP of Department is pending before Supreme Court as on 31.01.2020 or the time to file appeal or writ or SLP by the department in SC has not expired on 31.01.2020. | Please fill the below details in case the appeal/writ is related to “Disputed tax” and pending with “Supreme Court” filed by “Department/Both”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “Supreme court” filed by “Department/Both”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which appeal or writ or SLP filed or appeal or SLP to be filed | Please enter the total income as per order against which appeal/writ/SLP filed or to be filed |

| B. | Disputed income out of A | Please enter the Disputed income out of A |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed Tax in relation to disputed income at B |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*C | |

| If search case 0.625*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*C | |

| If search case 0.675*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*C | |

| Schedule X. To be filled in case revision application of Assessee u/s 264 is pending before PCIT/CIT as on 31.01.2020 | Please fill the below details in case the revision is related to “Disputed tax” and pending with “PCIT/CIT” filed by “Assessee”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “PCIT/CIT” filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Total income as per order against which revision application filed | Please enter the total income as per issued order against which appeal filed or to be filed |

| B | Disputed income out of A | Please enter the disputed income out of A. |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed tax on disputed income at B. |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as C+D+E and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than C | |

| If search case 1.25*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*C | |

| If search case 1.35*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*C | |

| Schedule XI. To be filled in case arbitration or conciliation or mediation of Assessee is pending as on 31.01.2020 | Please fill the below details in case the appeal is related to “Disputed tax” pending before arbitration or conciliation or mediation which is filed by “Assessee”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal is pending before arbitration or conciliation or mediation which is filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A | Total income as per order against which arbitration or | Please enter the total income as per issued order against which appeal filed or to be filed |

| conciliation or mediation has been filed | ||

| B | Disputed income out of A | Please enter the disputed income out of Total income as per order against which arbitration or conciliation or mediation has been filed. |

| C | Disputed tax in relation to disputed income at B | Please enter the disputed tax amount in relation to disputed income at B. |

| D | Interest charged on disputed tax | Please enter the Interest charged on disputed tax |

| E | Penalty levied on disputed tax | Please enter the Penalty levied on disputed tax |

| F | Tax arrears (C+D+E) | This field shall be auto populated as E+F+G and non-editable. |

| Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. | |

| If non search case C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than C | |

| If search case 1.25*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*C | |

| Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. | |

| If non search case 1.1*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*C | |

| If search case 1.35*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*C |

FIELD WISE INSTRUCTIONS FOR FILLING ANNEXURE B

Note: If appellant is having more than one appeal pending with same combination for selected FY, please click on add row and please fill the details accordingly.

| S. No. in Form | Field | Instructions |

| B. Schedules applicable where declaration relates to disputed TDS/TCS (Applicable for TAN): | Incase of TDS/ TCS appeals, this schedule need to be filled. Please ensure to fill the details regarding each appeal in different tables by using add row. | |

| Schedule I. To be filled in case appeal of Assessee is pending before CIT(A) as on 31.01.2020 or the time for filing appeal by the Assessee before CIT(A) has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “CIT(A)” filed by “Assessee” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “CIT(A)” filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Amount of TDS / TCS disputed in appeal or in appeal to be filed- | This field shall be auto populated as A(i)+A(ii) and non-editable. |

| A(i) | relating to issues, which have been decided in favour of Assessee in his case for any financial year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) | Please enter the amount of TDS/ TCS which have been decided in favour of Assessee in his case for any financial year by ITAT (and such order has not been subsequently reversed by the High Court) or High Court (and such order has not been subsequently reversed by the Supreme Court) |

| A(ii) | relating to issues other than A(i) | Please enter the amount of TDS/ TCS related to other than amount mentioned in A(i). |

| B | Tax effect of enhancement*, if any, by CIT(A) | Please enter the TDS/ TCS effect of enhancement, if any, by CIT(A) |

| C | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| D | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| E | TDS / TCS arrears (A+B+C+D) | This field shall be auto populated as A+B+C+D and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*A(i) + A(ii) + B | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*A(i) + A(ii) + B | |

| If search case 0.625*A(i) +1.25*A(ii) + 1.25*B | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*A(i) +1.25*A(ii) + 1.25*B. | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*A(i) + 1.1*A(ii) + 1.1*B | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*A(i) + 1.1*A(ii) + 1.1*B | |

| If search case 0.675*A(i) +1.35*A(ii) + 1.35*B | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*A(i) +1.35*A(ii) + 1.35*B | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule II. To be filled in case appeal of Assessee is pending before ITAT as on 31.01.2020 or the time for filing appeal by the Assessee before ITAT has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “ITAT” filed by Assessee/Both | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “ITAT” filed by Assessee/Both. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| A. | Amount of TDS / TCS disputed in appeal or in appeal to be filed- | This field shall be auto populated as A(i)+A(ii) and non-editable. |

| A(i) | relating to issues, which have been decided in favour of Assessee in his case for any financial year by High Court (and such order has not been subsequently reversed by the Supreme Court) | Please enter the amount of TDS/ TCS which have been decided in favour of Assessee in his case for any financial year by High Court (and such order has not been subsequently reversed by the Supreme Court) |

| A(ii) | relating to issues other than A(i) | Please enter the amount of TDS/ TCS related to other than amount mentioned in A(i). |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*A(i) + A(ii) | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*A(i) + A(ii) | |

| If search case 0.625*A(i) +1.25*A(ii) | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*A(i) +1.25*A(ii) | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*A(i) + 1.1*A(ii) | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*A(i) + 1.1*A(ii) | |

| If search case 0.675*A(i) +1.35*A(ii) | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*A(i) +1.35*A(ii) | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule III. To be filled in case appeal of Department is pending before ITAT as on 31.01.2020 or the time to file appeal by the department in ITAT has not expired on 31.01.2020. | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “ITAT” filed by “Department” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “ITAT” filed by “Department”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which appeal is filed or to be filed | Please enter the amount of TDS/ TCS default for which appeal is filed or to be filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5*A | |

| If search case 0.625*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*A | |

| If search case 0.675*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule IV. To be filled in case appeal or writ of Assessee is pending before High Court as on 31.01.2020 or the time for filing appeal or writ by the Assessee before High Court has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “High court” filed by “Assessee” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “High Court” filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which writ or appeal is filed or to be filed | Please enter the amount of TDS/ TCS default for which writ or appeal is filed or to be filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than amount at field A | |

| If search case 1.25*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*value at field A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*A | |

| If search case 1.35*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule V. To be filled in case appeal or writ of Department is pending before High Court as on 31.01.2020 or the time to file appeal or writ by the department in HC has not expired on 31.01.2020. | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “High Court” filed by “Department” | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “High Court” filed by “Department”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which writ or appeal is filed or to be filed | Please enter the amount of TDS/ TCS default for which writ or appeal is filed or to be filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5* amount at field A | |

| If search case 0.625*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*value at field A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*A | |

| If search case 0.675*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule VI. To be filled in case appeal or writ or SLP of Assessee is pending before Supreme Court as on 31.01.2020 or the time for filing appeal or writ or SLP by the Assessee before Supreme Court has not expired as on 31.01.2020 | Please fill the below details incase the appeal is related to “Disputed tax” and pending with “Supreme Court” filed by Assessee / Both | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with Supreme Court” filed by “Assessee” / Both. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which writ or appeal or SLP is filed or appeal / SLP to be filed | Please enter the amount of TDS/ TCS default for which writ or appeal is filed or to be filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than amount at field A | |

| If search case 1.25*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*value at field A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*A | |

| If search case 1.35*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule VII. To be filled in case appeal or writ or SLP of Department is pending before Supreme Court as on 31.01.2020 or the time to file appeal or writ or SLP by the department in SC has not expired on 31.01.2020. | Please fill the below details incase the appeal is related to “Disputed tax” and pending with Supreme Court” filed by “Department” / Both | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal related to “Disputed tax” and pending with “Supreme Court” filed by “Department” / Both.Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which writ or appeal or SLP is filed or appeal / SLP to be filed | Please enter the amount of TDS/ TCS default for which writ or appeal is filed or to be filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.5*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.5* amount at field A | |

| If search case 0.625*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 0.625*value at field A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 0.55*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.55*A | |

| If search case 0.675*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 0.675*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule VIII. To be filled in case revision application of Assessee u/s 264 is pending before PCIT/CIT as on 31.01.2020 | Please fill the below details incase ‘revision’ application of Assessee u/s 264 is pending before ‘PCIT/CIT’ | |

| Appeal reference number | Please enter the “Appeal Reference Number” and please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in revision application filed | Header | |

| A | TDS/TCS default for which revision application filed | Please enter the TDS/TCS default for which revision application filed. |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than A | |

| If search case 1.25*A | If dispute is related to search case then please enter TDS / TCS payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*A | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*A | |

| If search case 1.35*A | If dispute is not related to search case then please enter TDS / TCS payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*A | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. | |

| Schedule IX. To be filled in case arbitration or conciliation or mediation of Assessee is pending as on 31.01.2020 | Please fill the below details in case the appeal is related to “Disputed tax” pending before arbitration or conciliation or mediation which is filed by “Assessee”. | |

| Appeal reference number | Please enter the “Appeal Reference Number” for the appeal is pending before arbitration or conciliation or mediation which is filed by “Assessee”. Please ensure that the same should match with the “Appeal Reference Number” entered in Part B. | |

| Amount of TDS / TCS disputed in appeal or in appeal to be filed | Header | |

| A | TDS/TCS default for which arbitration or conciliation or mediation has been filed | Please enter the TDS/TCS default for which arbitration or conciliation or mediation has been filed |

| B | Interest charged on disputed TDS / TCS | Please enter the Interest charged on disputed TDS / TCS |

| C | Penalty levied on disputed TDS / TCS | Please enter the Penalty levied on disputed TDS / TCS |

| D | TDS / TCS arrears (A+B+C) | This field shall be auto populated as A+B+C and non-editable. |

| X | Amount payable under DTVSV on or before 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case C | If dispute is not related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than C | |

| If search case 1.25*C | If dispute is related to search case then please enter tax payable under DTVSV on or before 31.03.2020 and also ensure that this amount should not be less than 1.25*C | |

| Y | Amount payable under DTVSV after 31.03.2020 | This field shall be auto populated as sum of below fields and non editable. |

| If non search case 1.1*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.1*C | |

| If search case 1.35*C | If dispute is not related to search case then please enter tax payable under DTVSV after 31.03.2020 and also ensure that this amount should not be less than 1.35*C | |

| Add Row | If user is having more than one appeal pending with same combination for that FY, please click on add row and enter the details properly. |

You can also download the Details Procedure for Filing of Vivad se Vishwas Scheme Form 1 and 2 in PDF link given below.

Vivad se Vishwas Scheme Notification PDF