QRMP Scheme GST

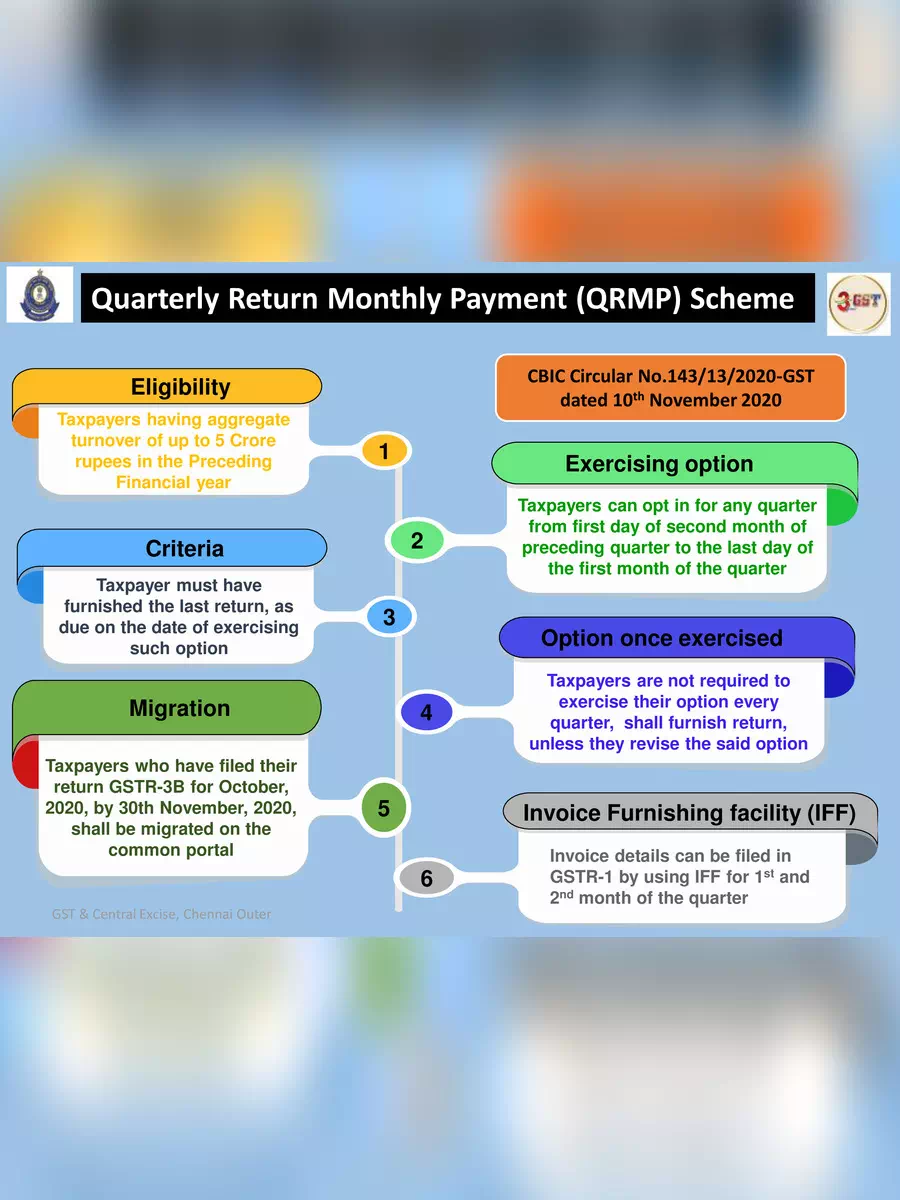

The Central Board of Indirect Taxes & Customs (CBIC) introduced Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme under Goods and Services Tax (GST) to help small taxpayers whose turnover is less than Rs.5 crores. The QRMP scheme allows the taxpayers to file GSTR-3B on a quarterly basis and pay tax every month.

Eligible Persons for the QRMP scheme

- A registered person who is required to furnish a return in FORM GSTR-3B, and who has an aggregate turnover of up to 5 crore rupees in the preceding financial year, is eligible for the QRMP Scheme. Further, in case the aggregate turnover exceeds five crore rupees during any quarter in the current financial year, the registered person shall not be eligible for the scheme from the next quarter.

- It is clarified that the aggregate annual turnover for the preceding financial year shall be calculated in the common portal taking into account the details furnished in the returns by the taxpayer for the tax periods in the preceding financial year.The quarterly GSTR-3B filing option will be available from 1st January 2021 onwards. It is clarified that this scheme is optional and can be availed based on GSTIN.

How to exercise Option for QRMP Scheme

A registered person who intends to file his GSTR-3B quarterly should indicate the same on the GST portal, from the 1st of the second month of the preceding quarter until the last day of the first month of the quarter for which such option is being exercised.

For example: If A wishes to file quarterly returns for the quarter of Jan-Mar 2021, he should opt for quarterly filing on the common GST portal between 1st November 2020 and 31st January 2021.

Once the registered person has opted for quarterly filing, he will have to continue to furnish his return every quarter for all future tax periods, except in the following situations:

- If the taxpayer becomes ineligible for furnishing a quarterly return (for example, if the aggregate turnover crosses Rs.5 crore during a quarter, then from the next quarter he will not be able to file quarterly returns).

If the taxpayer opts to furnish GSTR-3B on a monthly basis. - A registered person will not be eligible to opt for furnishing quarterly returns if the last return, which was due on the date of exercising such an option has not been furnished.

For example: If the person is opting for quarterly GSTR-3B filing on 1st December 2020, he will need to furnish his GSTR-3B return for October 2020, which would have been the last return due on the date of exercising the quarterly filing option.

| S No. | Class of Registered Persons | Deemed Option |

| 1 | Registered individuals with an aggregate turnover of up to Rs.1.5 crore, who have furnished Form GSTR-1 quarterly in the current financial year | Quarterly GSTR-3B |

| 2 | Registered persons with an aggregate turnover of up to Rs.1.5 crore, who have furnished Form GSTR-1 monthly in the current financial year | Monthly GSTR-3B |

| 3 | Registered persons having an aggregate turnover exceeding Rs.1.5 crore and up to Rs.5 crore in the preceding financial year | Quarterly GSTR-3B |

For more details download the QRMP Scheme GST in PDF format using the link given below or an alternative link.