GST Registration Limit 40 Lakhs Notification

Business Persons whose annual turnover of more than Rs. 40 lakhs (Rs. 20 lakhs for businesses in some special category states) are required to register for GST. The GST Council raised the minimum threshold for GST registration from 20 lakhs to 40 lakhs (from Rs.10 lakhs to Rs.20 lakhs for special category states) in consideration of MSMEs’ concerns, thereby relieving many small businesses from paying GST.

However, certain businesses, such as those engaged in e-commerce or selling goods across state borders, are required to register for GST regardless of their turnover. It is important to check the GST laws and regulations in a specific region to determine the minimum limit for registration.

GST Registration Exempted Categories

- Supply of goods or services not liable to tax.

- Supply of goods or services by an unregistered individual to a registered individual.

- Supply of goods or services by an unregistered e-commerce operator.

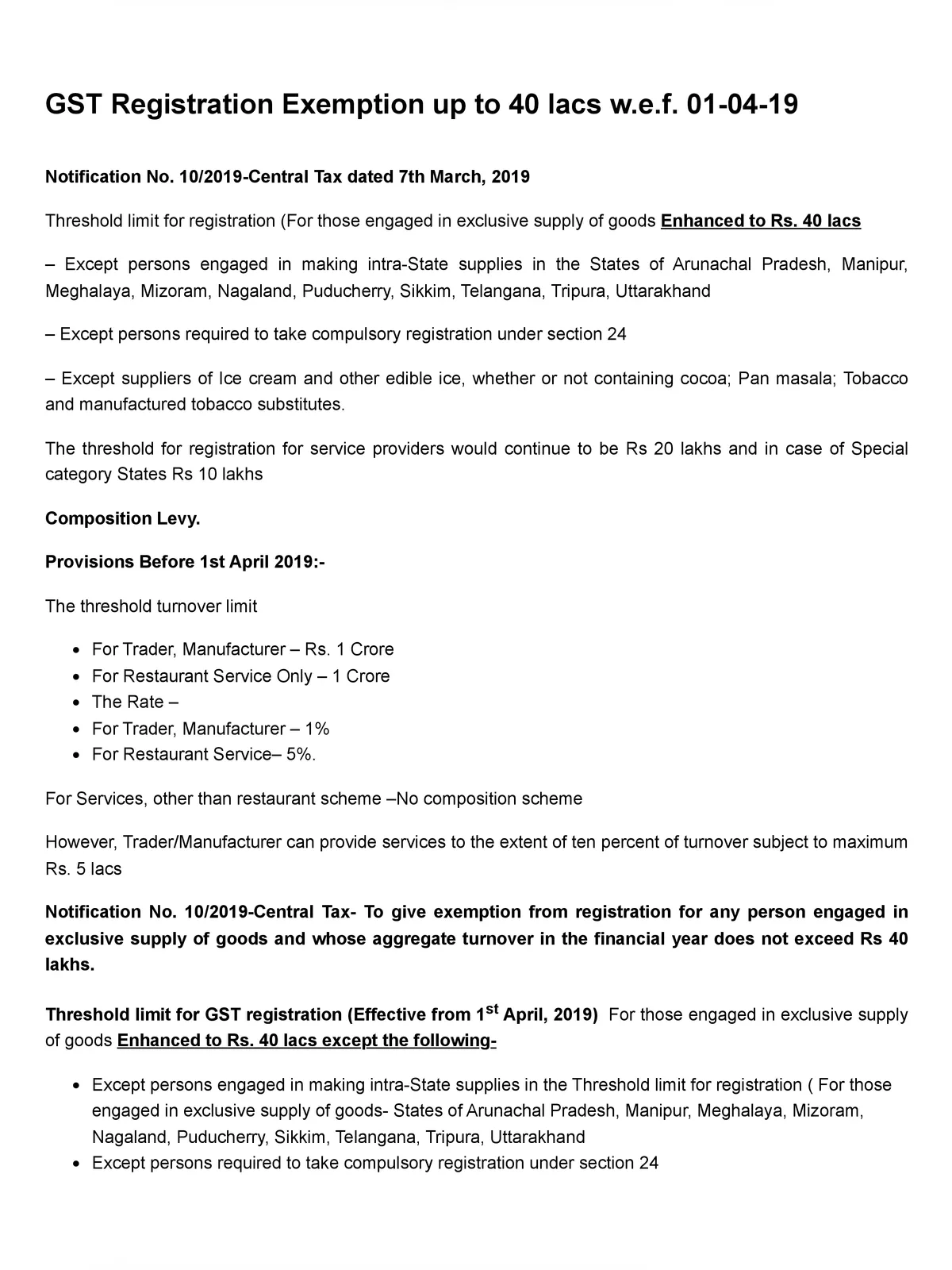

GST Registration Limit 40 Lakhs Notification

Threshold limit for GST registration (Effective from 1st April 2019) For those engaged in the exclusive supply of goods Enhanced to Rs. 40 lacs except the following-

- Except persons engaged in making intra-State supplies in the Threshold limit for registration ( For those engaged in the exclusive supply of goods- States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripura, Uttarakhand

- Except persons required to take compulsory registration under section 24

- Except for suppliers of Ice cream and other edible ice, whether or not containing cocoa; Pan masala; Tobacco and manufactured tobacco substitutes

The threshold for registration for service providers would continue to be Rs 20 lakhs and in case of Special category States Rs 10 lakhs

You can download the GST Registration Limit 40 Lakhs Notification PDF using the link given below.