Form 16 (Part A & Part B) – Download Procedure

Form 16:- Form 16 is an Income tax form. It is used by the companies to provide their salaried individuals information on the tax deducted. In simple terms, Form 16 is a certificate provided by your employer which certifies details regarding the salary you have earned during the year and how much TDS has been deducted.

Online Procedure to Download Form 16 (Part A & Part B)

Following are Steps to generate Form 16 Part-A from TRACES:-

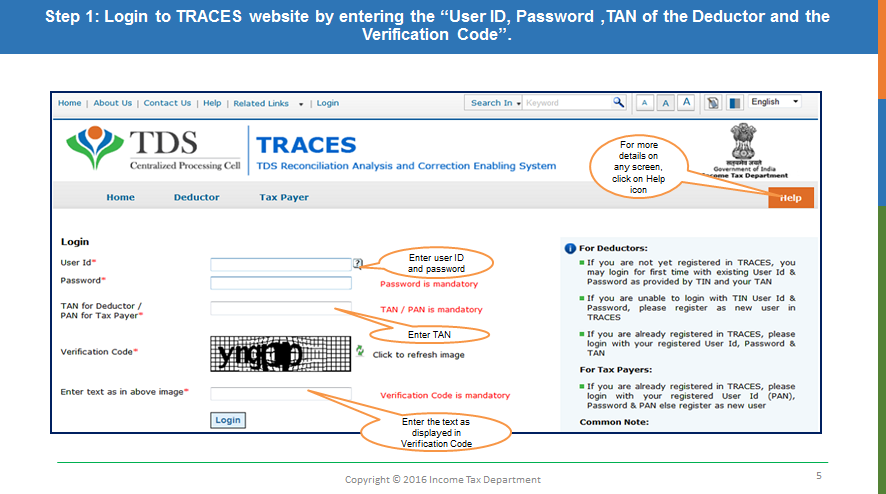

Step 1:-, First of all, you have to visit the Traces official website www.tdscpc.gov.in by entering the “User ID, Password, TAN of the Deductor, and the Verification Code” as shown below.

Step 2:- After login into Traces Site, You have checked the statement status under “Statement/Payment Tab” before raising the request for Form 16. Request for Downloading Form 16 can only be submitted when statement status is either “ Processed with Default” or “Processed without Default”.

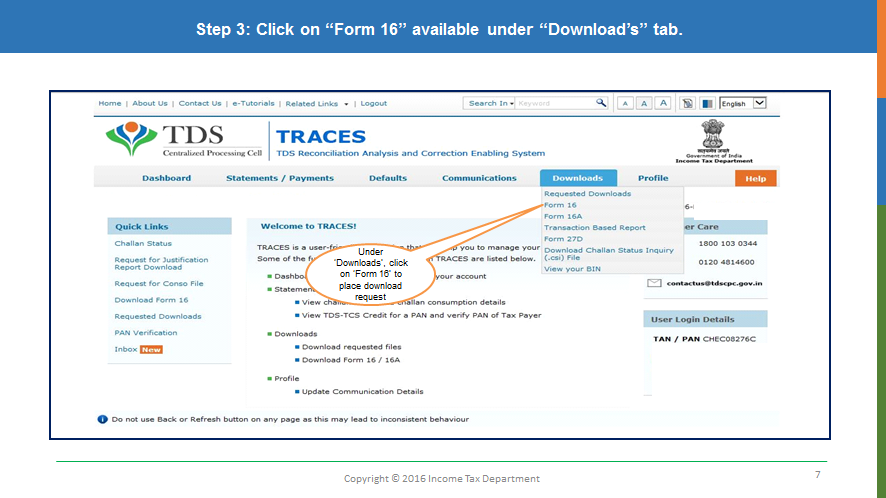

Step 3:- Click on “Form 16” option which is available under “Download’s” tab as shown below

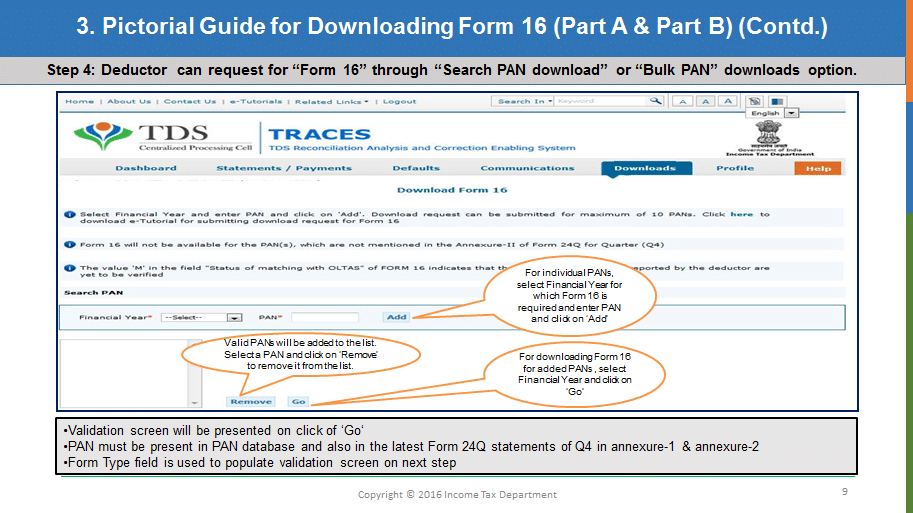

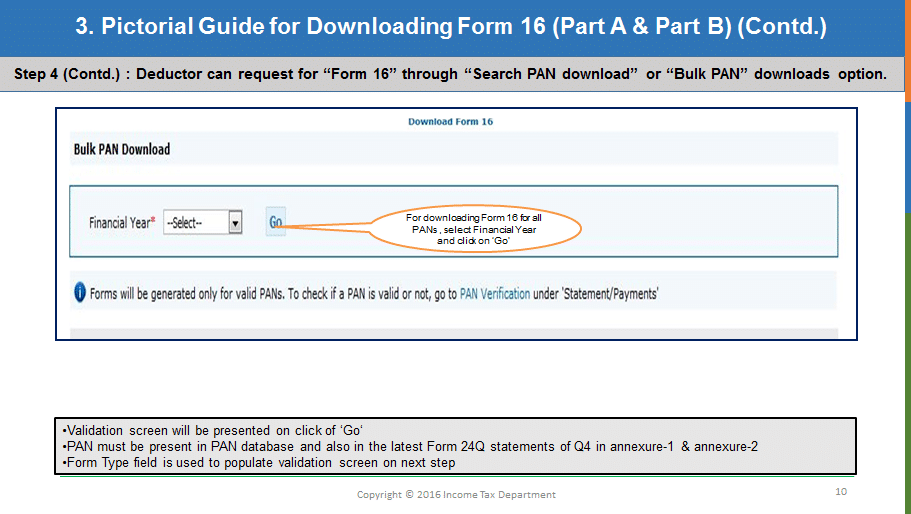

Step 4:- Deductor can request for “Form 16” through “Search PAN Download” or “Bulk PAN” download options as shown below

Search PAN download” option is to download Form 16 Part-A of selected valid PAN’s as shown below:

“Bulk PAN download” option is to download Form 16 Part-A of all valid PAN’s fo that Financial Year as shown below:

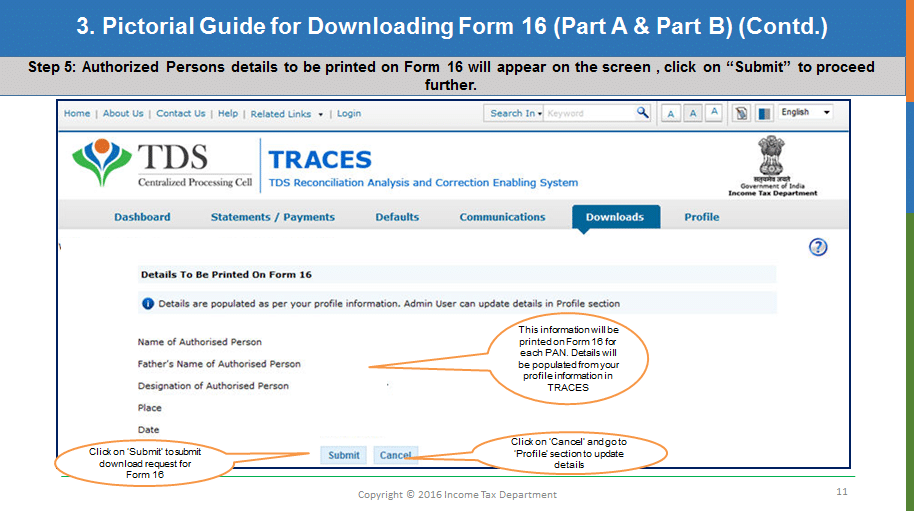

Step 5:- Details of Authorized Persons to be printed on Form 16 Part-A will appear on the screen, click on “Submit” to proceed further. If any changes needed then click “ Cancel” and go to the profile section and update the details.

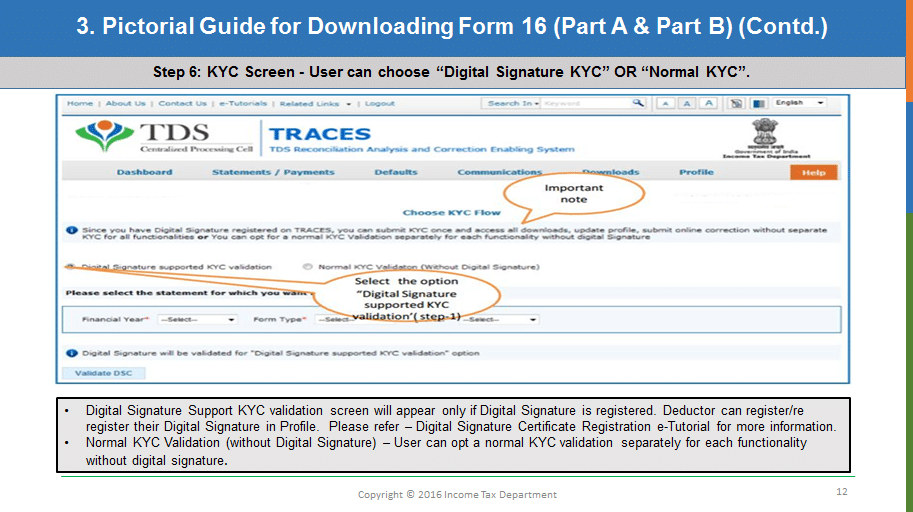

Step 6:- Fill the KYC details by selecting and one of the options as Digital Signature Supported KYC: This KYC validation can opt only if Digital Signature is registered in TRACES login. Deductor can register/re-register their Digital Signature in Profile as shown below:

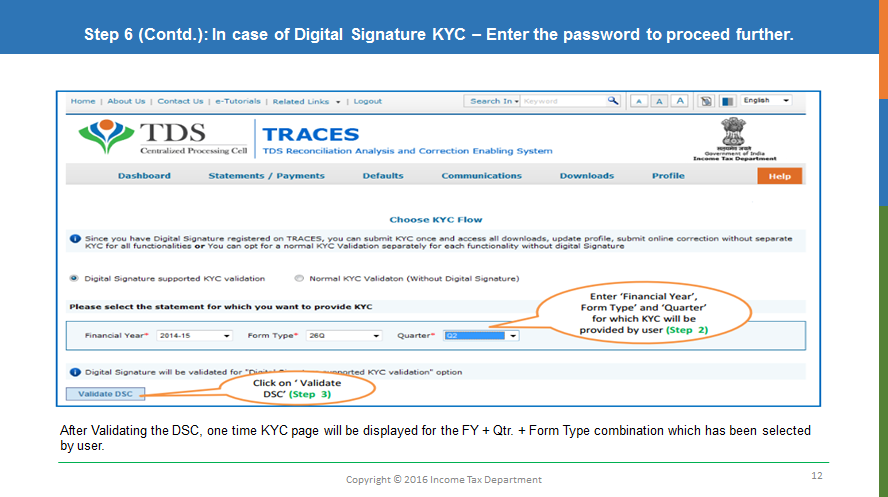

Step 7:- Financial Year, Form type, and Quarter for which KYC required will be auto-populated as shown below:

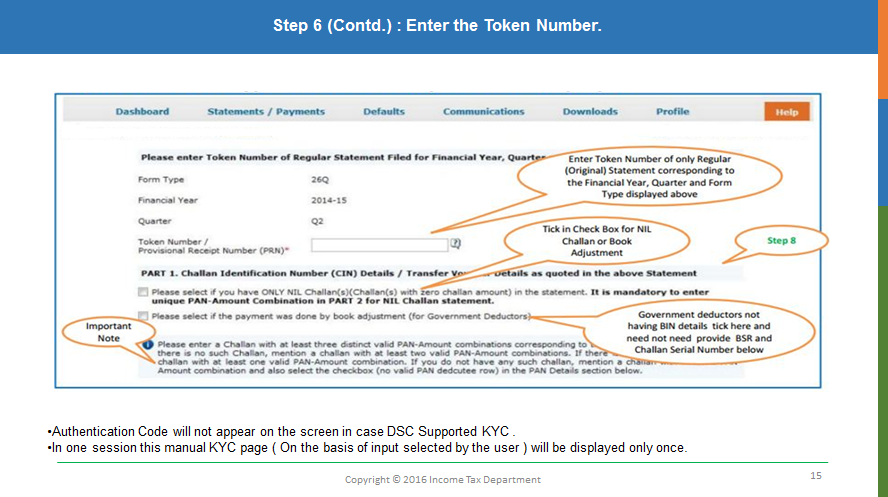

Step 8:- Enter Token of the Regular(Original) Statement only, corresponding to the Financial Year, Quarter, and Form types Displayed. Enter CIN/Valid Pan details pertaining to the financial year, Quarter, and Form type displayed on the screen on the basis of the latest correction statement filled by you. Please DO NOT copy/paste the data as shown below:

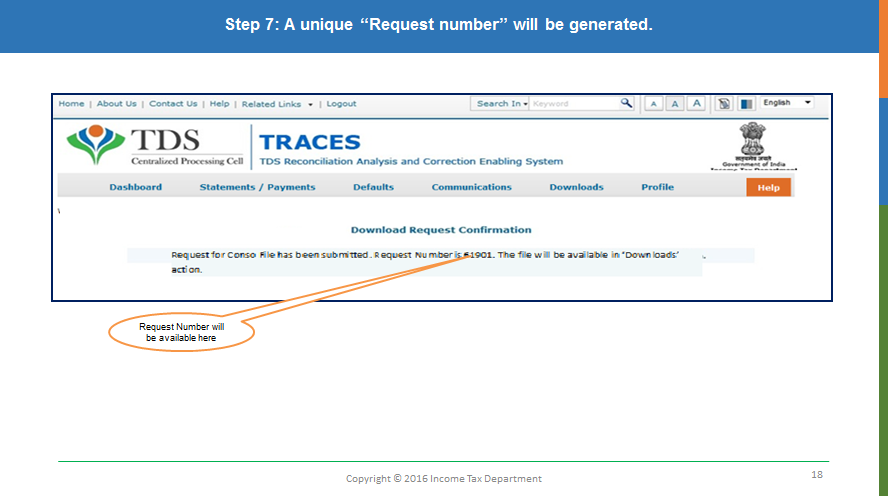

Step 9:- A unique “Request number” will be generated, On successful submission of the request which can be used to track the status of the request. Form 16 Part-A can only be downloaded if the status is “Available”, the user needs to wait for 24- 48 hrs in case request is in “Submitted” status as shown below

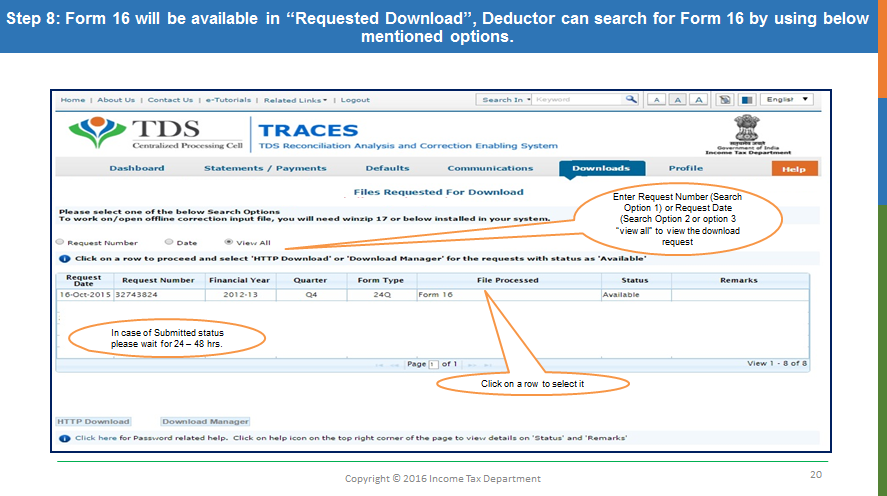

Step 10:- Form 16 Part-A files can be download from “Download” >> “Requested Download” tab by using any one of the option “HTTP download” or “Download Manager” as shown below:

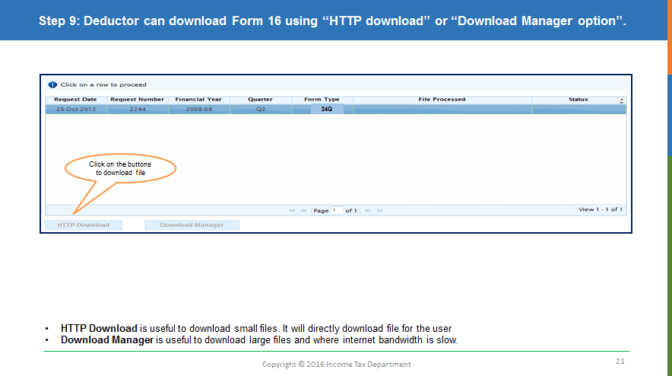

Step 11:- Select the type of download depending on the number of files.

- HTTP Download is useful to download small files.

- Download Manager is useful to download large files and where internet bandwidth is slow as shown below:

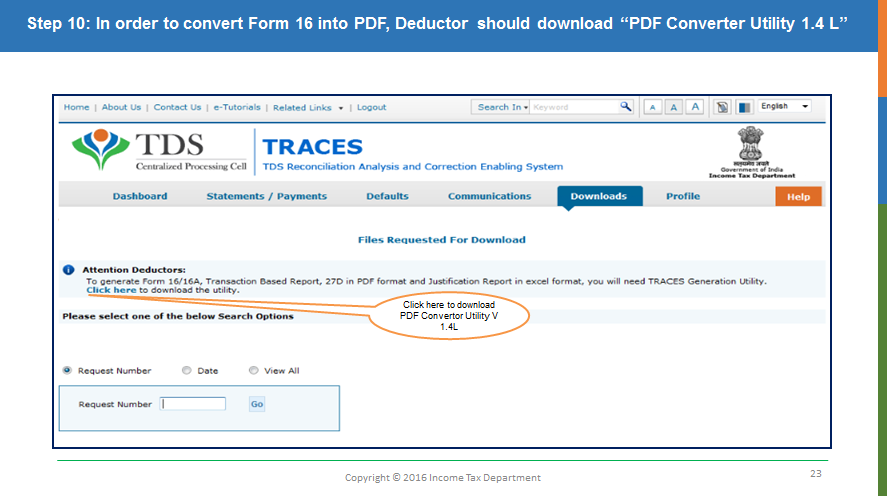

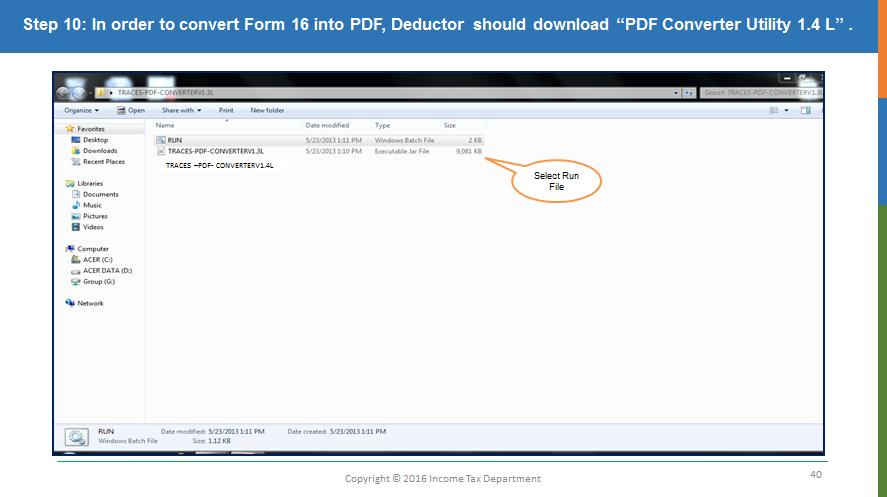

Step 12:- Download “Form 16 PDF Converter Utility 1.4 L” to convert Form 16 Part-A into PDF format. Converter Utility can be Downloaded from “Download” >> “Requested Download” tab

Step 13:-Run the setup of “Form 16 PDF Converter Utility 1.4 L” then browse the downloaded files and click Proceed to Generate Form 16 Part-A in PDF.

You can download the Form 16A/16E-Tutorial Procedure in PDF format.

SHARE YOUR FEEDBACKIf the you have any issues with the content given above, or you feel any problem with it, please WRITE A COMMENT and enter the appropriate description in comment text such as copyright material / promotion content / links are broken etc.