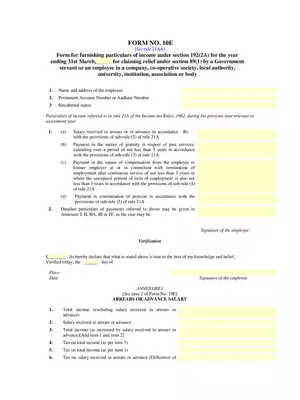

Form 10E Claim Relief Under Section 89(1)

Income Tax Form 10E is a form that is essential to save taxes on the income generated as arrears by utilizing the provisions given by Section 89(1) of the Income Tax Act of 1961. This article talks about Form 10E and how one can reduce their tax liability by filing the same.

Receiving salary or pension in arrears might change your tax situation. You may fear it’s going to move you up a tax slab. Or tax rates may be higher in the year arrears are received as compared to the year to which they belong. To protect you from any additional tax burden, due to delay in receiving income, the tax laws allow a relief under Section 89(1). This relief can be directly claimed in your income tax return, if you have received any portion of your salary in arrears.

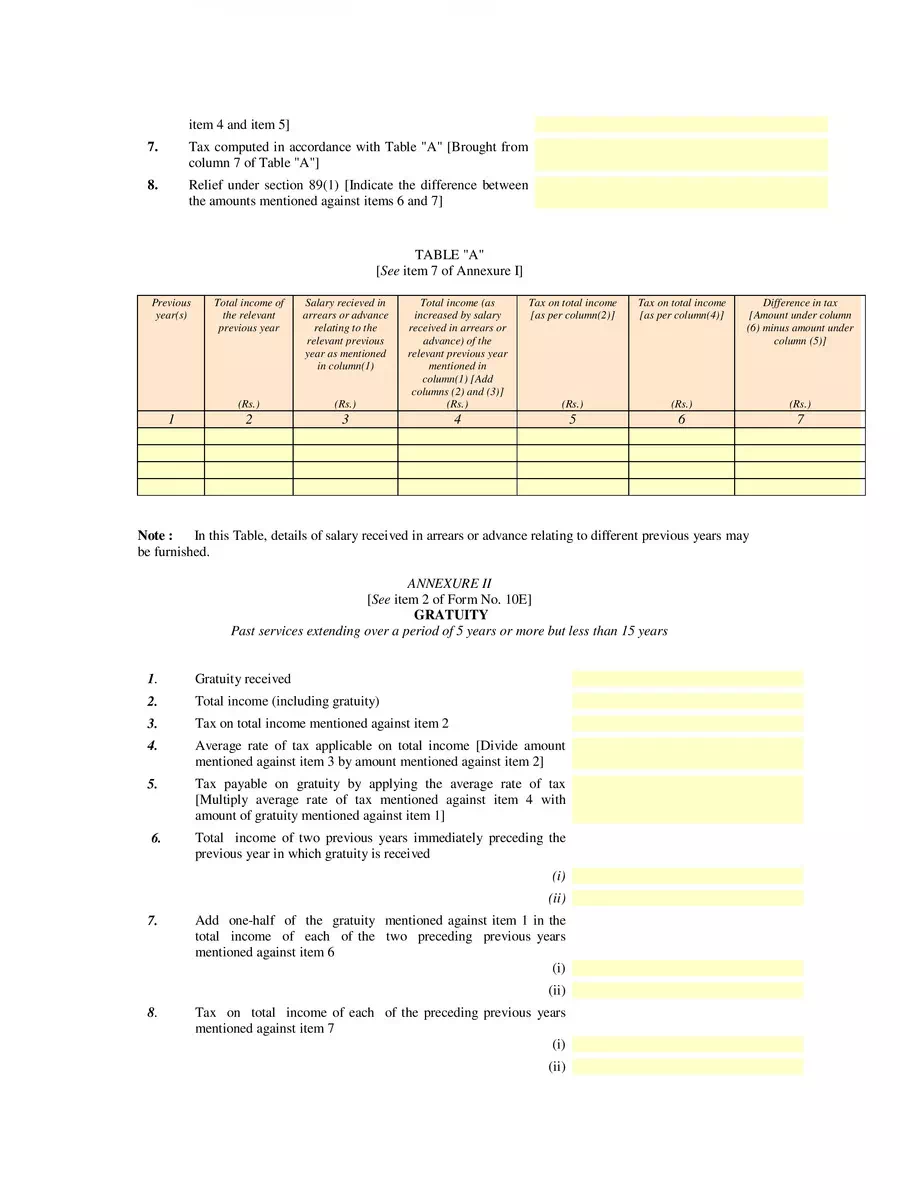

The Income Tax Department has made it mandatory to file Form 10E if you want to claim relief under Section 89(1). As per Section 89(1), tax relief is provided by recalculating tax for both the years; the year in which arrears are received and the year to which the arrears pertain. Your taxes are adjusted assuming arrears were received in the year in which they were due.

You can download the Form 10E Claim Relief Under Section 89(1) in PDF format using the link given below.

सिखरकुमार98978@जीमेल ,कम